Most investors are concerned about current share prices to plan for their exits as it affects their profits when exiting. However, it is also crucial to note that the entry price can also affect profits and yield significantly because our entry price determines the number of shares purchased with a specific amount of capital as well. In this week’s post, we will show how capital, entry price, and yields are correlated and how should we maximize our profits over time.

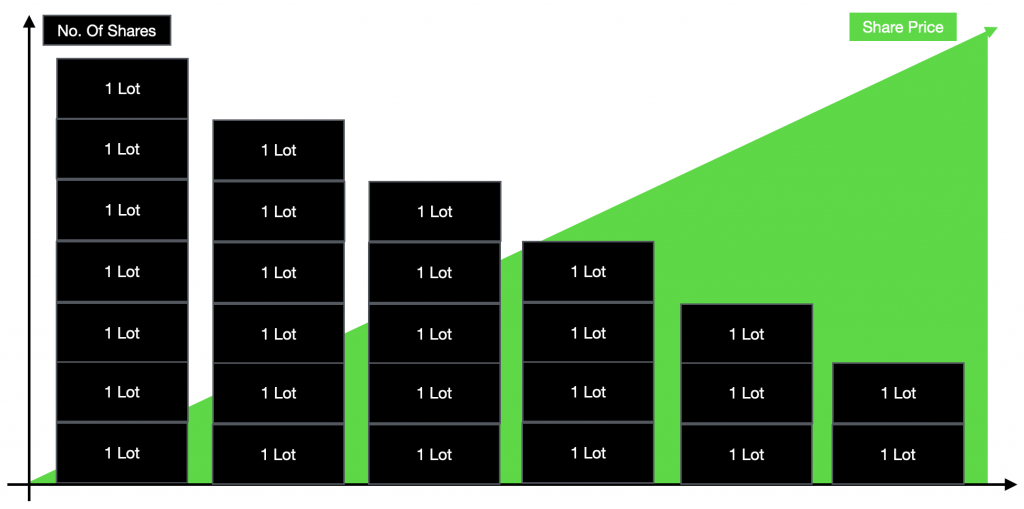

Investment tranches defined by amount of Capital

As investors, we should be mindful that share prices affects the number of shares purchased with the same amount of capital. As such, proper planning is essential even when you are using a periodic investment strategy. If you plan your entry with technical analysis and buy at a slightly lower price for each tranche, then you will be able to increase your total yield and reduce potential paper losses as well.

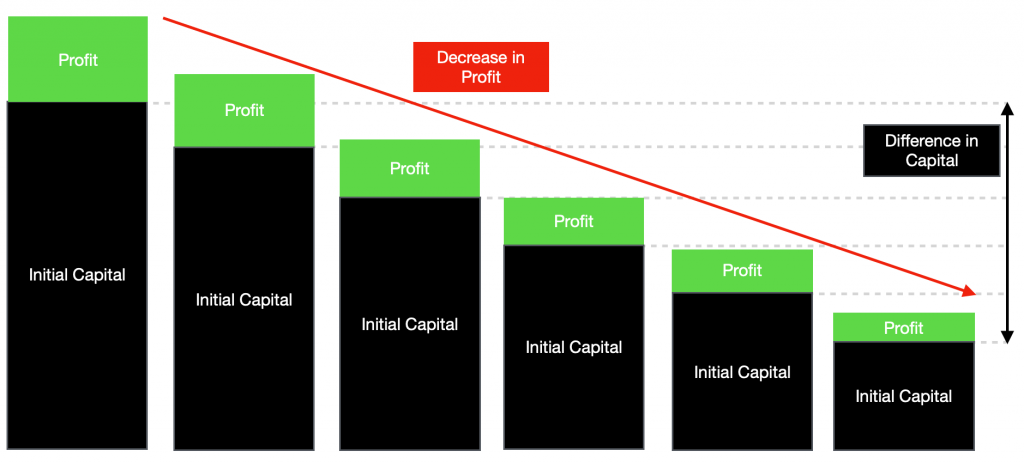

Difference in profits are proportionate to initial capital

Needless to say but the amount of capital vested will affect the actual profit or yields. That is why it is advisable that you save up larger sums of cash before jumping into investments. In the meantime, focus on maximizing your income and saving account interest rates.

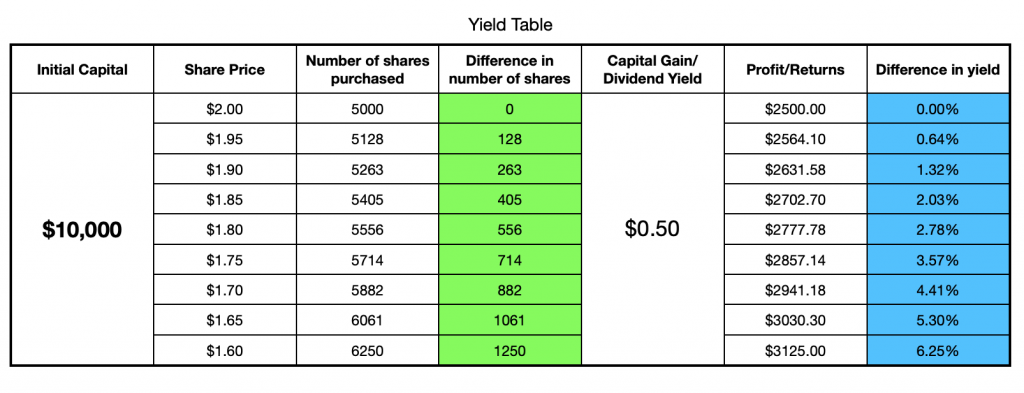

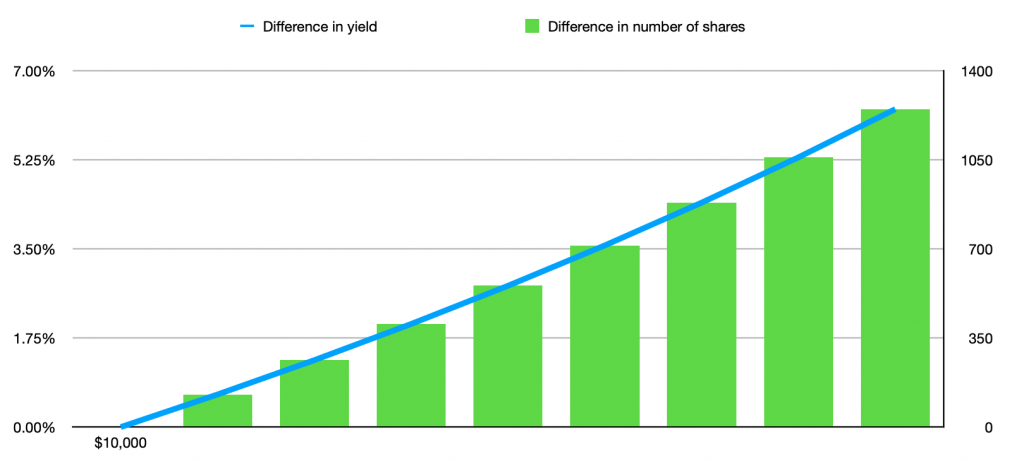

Difference in yield due to entry price

To combine all that was discussed earlier, the above and chart above show the impact of simply buying at different entry prices with the same amount of capital. The result is that the difference in real yield will increase at a slight geometric progression (X^2) thus it is important to spread out our purchases when buying with a dollar-cost averaging strategy.

Closing Thoughts

Thought this post is focused on the basics of investments, it does remind all levels of investors that they should always plan adequately before deploying capital. Such considerations will not only allow investors to get the best bang for their buck but also maximize their profits and yields over time.