In this environment where STI is consolidating with sharp fluctuations, it is hard to decide when to buy. On the other hand, buying and holding also present potential risks if shares prices drop or stagnate. To those worries, I would like to offer 3 reasons why buying and holding might be beneficial over time. These benefits come in multiple forms such as capital risk, technical Analysis and value appreciation.

Capital risk reduces over time

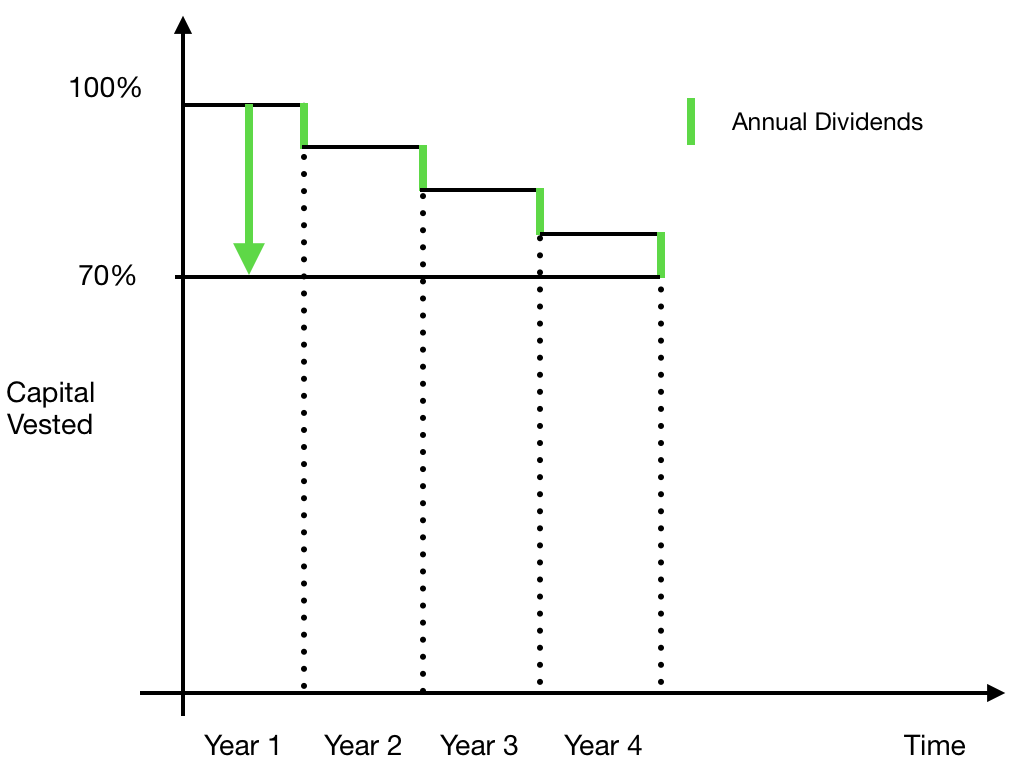

Many share counters distribute earnings to shareholders. With those rebates from dividends, the amount of capital vested decreases. This is accurate even when the share price fell exactly the same percentage as the dividends you receive. That said, it is highly unlikely for share prices to stagnate over long periods of time. Share prices tend to fluctuate in both directions and so long as the company continues to do decently well, there should be an appreciation in price.

Technical Analysis (Resistance turn support)

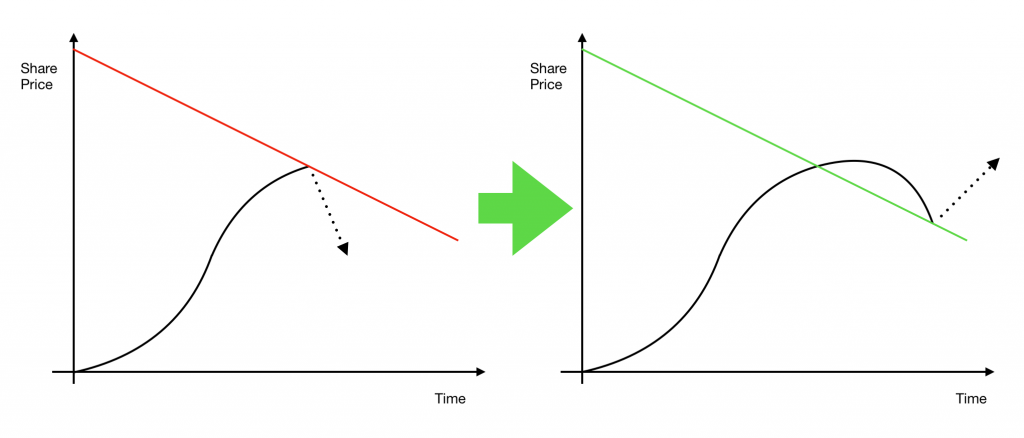

As share prices bounce from a trough or as it appreciates from the point of your purchase, there will be some resistance in its way. These resistance lines may vary in “strength” but when resistance breaks, the resistance will instead act as a support line. This means that as time goes by, share prices will form its own support lines to ensure that the fluctuations are kept in check. Though there is also a risk for support to turn into resistance, hence we should always plan our exits according to the counter’s business cycles.

Value appreciation

The word invest implies that the intention behind the purchase is to see price appreciation over time. Therefore, it is important to look out for companies that are likely to grow in terms of revenue and net profits over time. This will ensure that regardless of the entry price, the share price will continue to grow higher as its business continues to expand and do well. That is the reason why we should not buy solely for trades. Whilst there is always a basis to sell when there is a huge upside, you should also consider the alternative scenario when your predictions were incorrect. In such cases, buying a good company will provide some assurance after holding for a few months or years.

Closing thoughts

Time in the market allows investors to react to fluctuations and unexpected trends. We also believe that “time in the market beats timing the market” thus we recommend more investors to have a closer look at the market when investing. That way, we will be able to react according to the situations and employ strategies to maximize gains and minimize losses.