Many risk-averse individuals will usually go for time deposit accounts to store cash that they do not need urgently. This includes the usually fixed deposit accounts (12 months) as well as short term endowment-like plans (usually 1-3 years). Interestingly, some other accounts are starting to follow the style of time-deposit accounts to encourage savers to keep their monies in the bank. In today’s post, we will be studying High-Interest Saving Accounts, such as OCBC 360 account, OCBC Bonus Plus & Premier Dividend account to show how banks are moving away from Time deposit accounts to retain deposits and at the same time pay higher interests.

OCBC 360 Account – Maximising interest using salary crediting, selling investment and insurance products

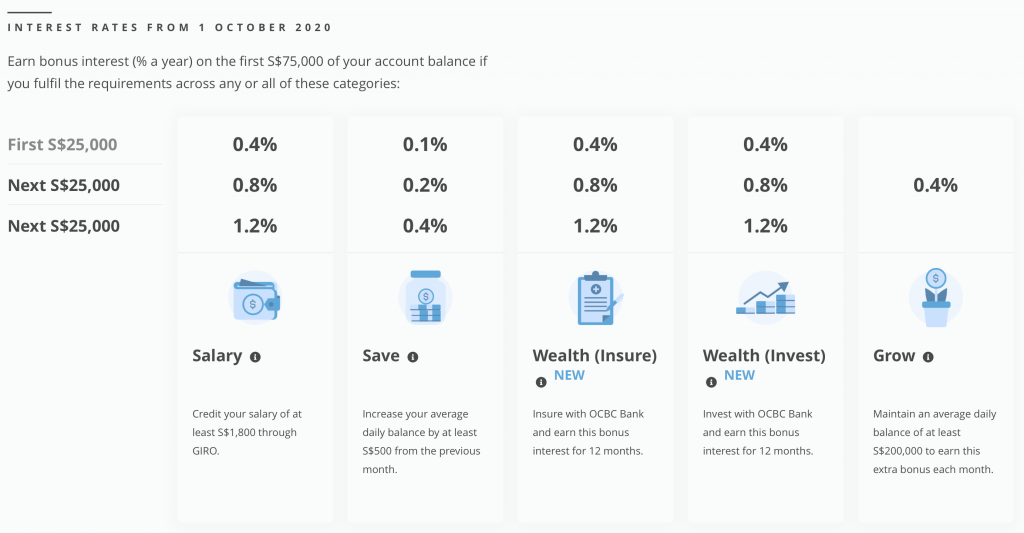

The OCBC 360 account has been weathered down due to the recent rate cuts in the US and other major economies. However, the general structure behind the OCBC 360 account remains the same. Apart from the basic requirements to credit your salary of at least $1800 per month, you are also encouraged to save a minimum of $500 to get a 1.08% per annum interest for the first $75,000 of your bank balance. Apart from this requirement, you are also encouraged to buy wealth products from the bank as you will be given the additional interest of up to 1.6% (2.68% in total for all 4 categories).

If you realized, this account requires u to keep at least $75,000 in the account and it does not contradict itself by penalizing you for spending or withdrawing any amount to pay for your insurance or wealth products. Any minor violations to the above requirements will lead to significantly lower interest credit for that month hence consumers who rely on this account to grow their savings will try their best to fulfill those criteria. Over time, this will become a habit, and saving in such a fashion will become second nature for OCBC 360 account owners.

OCBC Bonus Plus & (Premier Dividend+) accounts

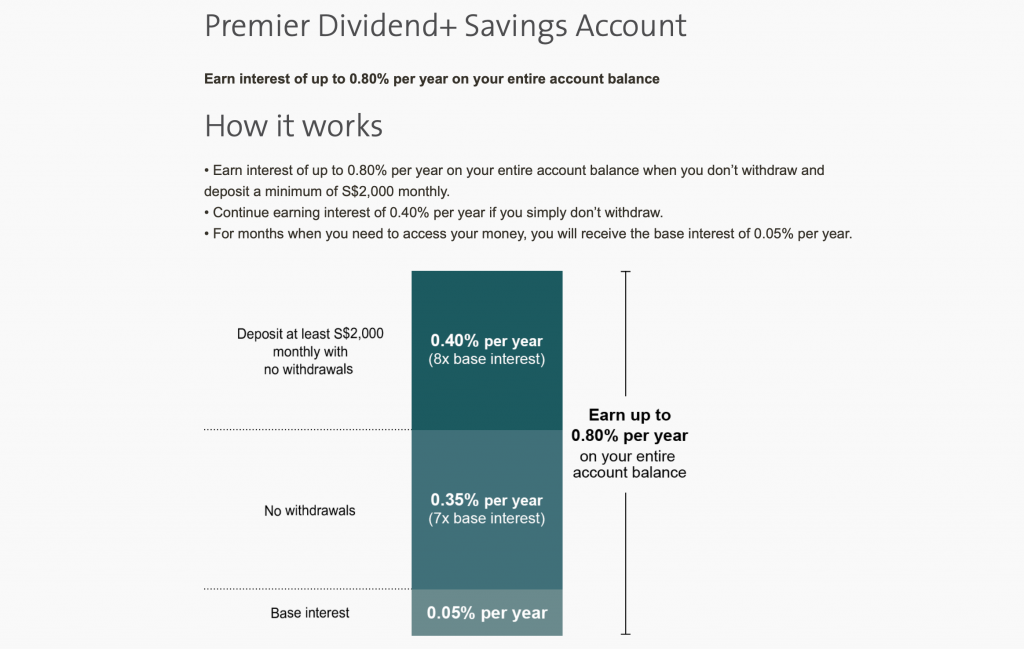

Both Bonus+ and Premier Dividend+ accounts are designed to create flexibility for savers to have an option to withdraw their cash at any time without forfeiting any more than 1 month of bonus interest. Unlike a time deposit account, both accounts promote a combination of lump-sum deposit as well as regular savings. Though it seems as if you are rewarded with higher interest if you deposit a minimum of $500 or $2000 per month respectively, it can also be viewed as a penalizing factor when compared to a fixed deposit account with no such requirements. Therefore, I would treat the condition for regular deposits as a trade-off for higher flexibility in terms of withdrawals. Either way, the main purpose of both Bonus+ and Premier Dividend+ accounts are meant to encourage you to keep as much cash as possible, in fact, I would argue that it trains savers to save increasing amounts over time.

Proposed method to maximise interest using both OCBC 360 and Bonus+/PD+ accounts

Well it goes without saying but as a believer in investing in stocks, I would refrain from investing in wealth products for the sake of small returns, however, if you are risk-averse, you should consider purchasing the minimum requirement to get the bonus wealth bonuses if you have more than $75,000. Otherwise, I would not promote additional spending or invest in those products for the bonus interests. Using a combination of both 360 and Bonus+/PD+ accounts, this is how I would save my monies.

- Maxed out OCBC 360 account and use it for salary crediting

- Transfer required amount of $500/$2000 respectively to Bonus+/PD+ (on 1st day of each calendar month)

- Transfer all excess cash into another spending account (for example POSB eMySavings Account – no fall below fee)

- Pay bills by routing funds back to OCBC 360 account to pay bills or for cash withdrawals

- Choose one month in the year to withdraw excess of $75,000 to maximize your interest using Bonus+/PD+ or other means

Closing Thoughts

Modern saving accounts have indeed evolved to cultivate habits in savers rather than locking down their funds, which in today’s context is considered undesirable. Using modern technology, savings accounts can afford greater flexibility when tracking expenditure, withdrawals, and account balances. That said, the above case study of sorts does suggest that HISAs are modern time deposit accounts disguised as regular saving accounts. Nevertheless, with higher interest rates than existing time-deposit accounts, it will be advisable to maximize our monthly interest using those accounts.