The pandemic has provided enough justifications for banks to pay us pathetic interest rates for our deposits. Time-Deposit accounts have also become a joke since the annual interest rates are insignificant by any standards. While the point of this post is not to discourage saving, I feel that it is getting harder for people to justify saving their money besides parking funds for emergencies. That said, I am going to share my personal views on saving, and perhaps these tips might work for you to emulate or consider for yourselves.

We have to reframe our ideas on saving

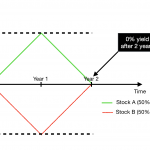

Gone are the days when saving equal to seeing a number on a screen or feeling a stack of cash in a biscuit tin. Having someone guaranteeing the value of your monies is frankly outdated. As a saver who wants to preserve the value of your monies, it is highly unwise to let it erode with inflation just because you do not know what to do with it. Instead, explore options like lower-yielding bonds to chuck your monies rather than hiring any advisor just to save money.

It is ok to merge saving with investing even when we are risk adverse

Entrusting funds to someone you can trust sounds like a good idea on any day. However, even that entails capital risk even if that person is your spouse or sibling. Therefore, be the role model in your family if you are the first to start investing in stocks and bonds by embracing adequate amounts of capital risk. Over time, you will realize that investing is less risky than most people think it is. Furthermore, you will eventually be rewarded with dividends and payouts even if you are going to be a passive investor. For example. buy the Astrea bond just to wet your feet a little and experience investing first hand. I am confident that this experience will be rewarding for you.

Look out for assets with tangible value for a store of value

Since time immemorial, people have stored value via the ownership of private property. It is not new to anyone if you think about it because all of us own things we do not really use but will be utterly reluctant to give them away due to their high innate value. On that note, I would like to first mention that storing the value in items like real estate and even cryptocurrencies is out of the question to savers for the following reasons. Firstly, real estate prices are really high and often they require the owner to apply for a loan which means there are regular interest payments to be paid. As for cryptocurrencies, if you are not already an investor and perhaps you don’t have a firm grasp on the idea of value, then refrain from buying into volatile assets such as cryptocurrencies which value is tagged to belief and confidence in its existent. For those crypto-believers out there who like to link this to the lunacy of how fiat currencies are valued, you shouldn’t contradict yourselves by buying something that is based on something equally or more ridiculous.

Closing Thoughts

After almost a hundred posts on investing and market outlooks, I feel it is time to do one on saving. Living in the era of low-interest rates, we must evolve and adapt by changing our own mindsets and sentiments about investment risks. Personally, I always try to put myself into the company’s shoes and think, who will be more concerned when the company is underperforming? The answer is obvious, as much as we call ourselves to share and bondholders, we are mostly nothing more than leeches of companies working to make a profit to impress us after a quarter or a financial year. In other words, if you are going to entrust your funds with a bank for example, why not buy its shares and get a much higher return for your capital?