Lately the market has reversed many months of gains in a short period of time. Don’t think it was an unthinkable scenario but overall it was still devastating enough for most investors to feel the pinch. Ever since the correction started, there were increasing numbers of social media posts stating that this drop was uncalled for and others were asking for moral support from investors in the same boat. Even though I am not severely impacted by this correction, I feel that this correction is still going to be useful for our journey as investors because there are always lessons to be learned from loss and misery. In today’s post, I will be sharing three lessons that I have learned so far from previous corrections and how I have grown from those experiences.

The market will not move in one direction indefinitely

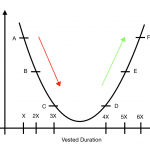

Markets are temperamental but they are usually trending in a certain direction until the next trigger comes. That said, it would be foolish to think that you are able to react at the best possible moment in time just before the trend reversal happens. Therefore, when the market continues to trend higher or lower, dont wait until the “last moment” before you react, instead, try to plan ahead for a suitable entry point and execute a logical strategy to manage any further price movements.

Larger corrections means that the market has been wrong in a bigger way

When the corrections are bigger than usual, investors should not be overly surprised because there will always be signs and signals that informs us about the sustainability of a particular trend. That said, if the trend persists, it does not always mean that those signs are inaccurate but rather the market is still controlled by the vast majority of investors and traders that believe in a particular fair value of a counter. In this recent correction, notice that it came way earlier than expected as the Fed decides to execute rate adjustments earlier and faster than usual. From this we observe that major trends are only reliable insofar as the main sustaining factor is based on facts. In this case, the whole idea that the inflation in the US was transitory was untrue and therefore resulting in a sizable correction.

Always stay objective when things get emotional

One of the most valuable lessons that we can learn from this correction is that we should never use our emotions to determine the actions and decisions we make in the market. However, I also understand that our objectivity is almost non-existent when the market continues to plunge that is why we should learn how to tune into our logical mind when that happens and base out decisions on objective reasoning. If we are able to master this, we will always be able to get better deals over time even if we are not able to buy at the absolute lowest price.

Closing Thoughts

Understanding why we feel what we feel is important as an investor because we should not allow the market reactions and trends to determine how we feel about our investments. In fact, we should always plan ahead and stay objective as much as possible to be the “odd one out” who is not caught in the mire of emotions like fear and greed.