When it comes to money matters, it is easy for us to cast doubt on ourselves when things do not go as plan. This self-doubt usually leads to poor judgment and reactive behaviors which will ultimately result in significant losses. In today’s post, we will go straight into brass tacks and tell you what are some regrettable things investors do when things go south. Essentially, our goal today is to build resilience when dealing with investment outcomes and prevent ourselves from falling prey to baseless sentiments.

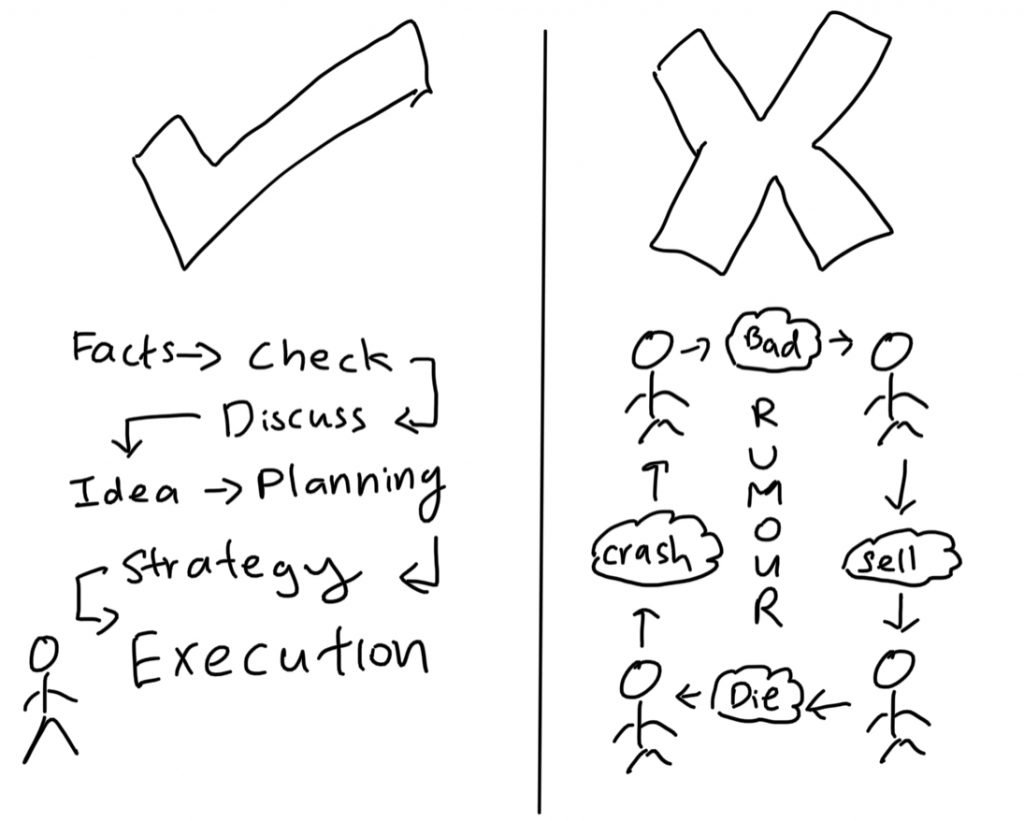

Loud rumours or quiet analysis?

We all know that investing takes a lot more than just relying on hearsay but sometimes, repeated rumors can feel overwhelmingly convincing. For example, there were multiple occasions when a counter has plunged without proper reasoning or announcements. However, due to the impacts of rumors circulating about how low those stocks would go (mostly are wrong and baseless), I stood back and watched the stock rebound thereafter. Those lessons learned in my earlier years of investing taught me to focus on legitimate methods and planning rather than amplified rumors.

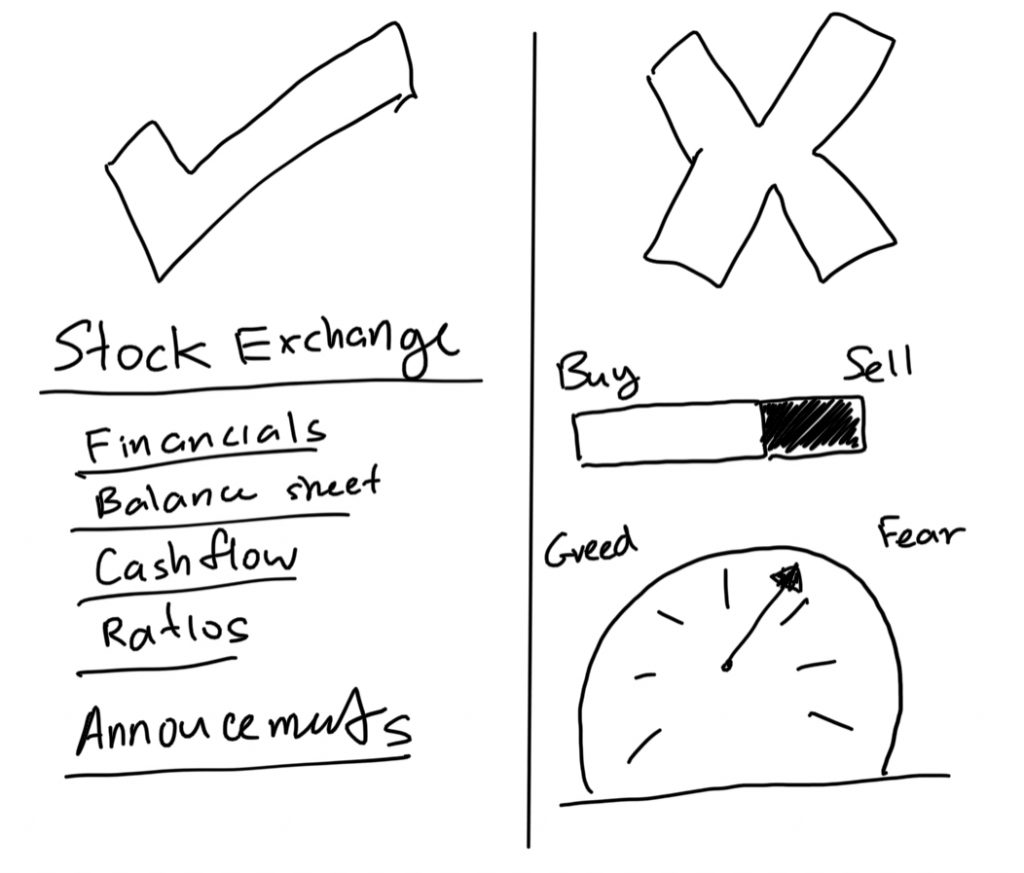

Modern Tools are (not) accurate

Technology has enabled us to track data like never before. Basically, we now have scales to measure fear and greed (not sure of its accuracy), and real-time tracking of buyers and sellers in the past 24 hours. These “Scales” are exceedingly impactful especially towards young investors who believe that the majority is always right. On the contrary, any successful or experienced investor will always emphasize that the sentiments of the collective are never always right. In fact, it could be a 50:50 chance of it being right or wrong, rendering it completely useless in most cases. That is why we should stick to the facts and available knowledge so as to stay grounded and rational when investing.

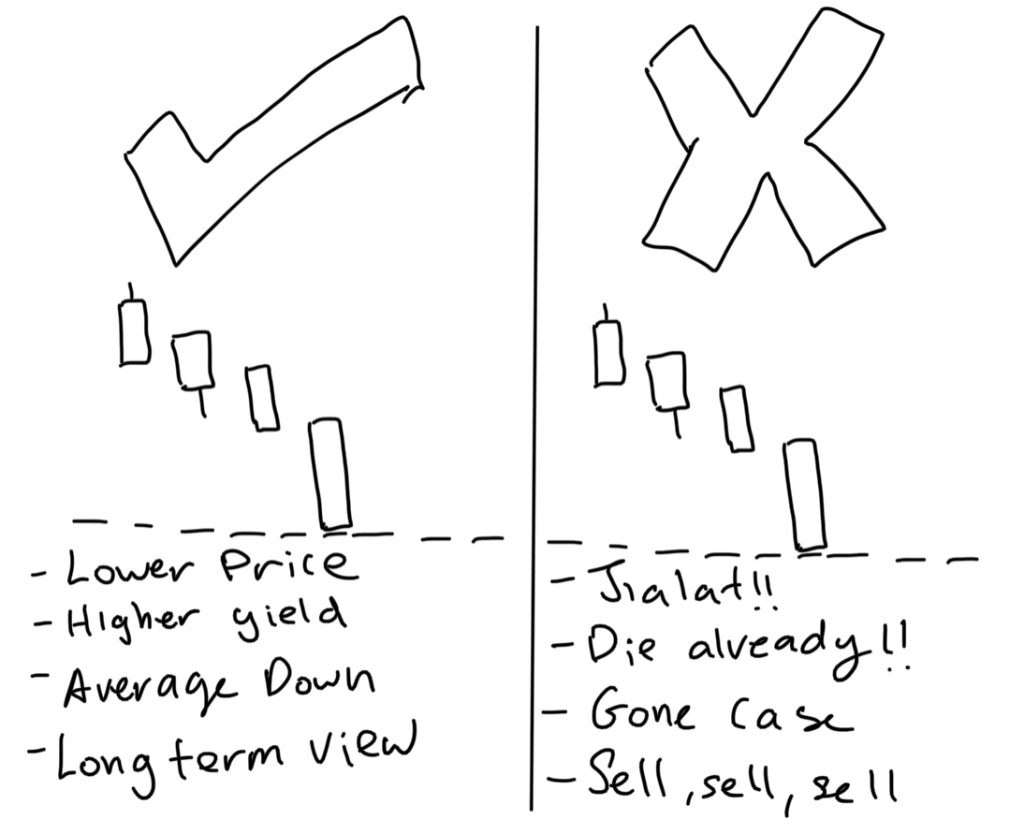

React rationally not emotionally

Any amateur will tell you that investing and trading basically rely on the idea of “buy low sell high”. But this logic never sticks when there is a downturn for those same amateurs because they react counterproductively when the dips or bearish price action happens. The next time you see a stock or market tank because of external factors unrelated to the business of the company, notice how most people would predict the doom day or price that is usually far fetched and unreachable. Bear in mind if you have planned and understood the current situation of the market, you should act based on your plans. In the end, you will realize that investing with discipline always wins in the long run.

Closing Thoughts

The right and wrong in investing are always mistaken as to who is the biggest winner or loser right now. It is hard to disagree with this logic but every experienced investor will tell you that it takes way more than a few right moves to build a steady and growing portfolio. If I was asked to summarise, it would be a focus on the fundamentals of the company you invest in and stay disciplined in your action plans. In a few year’s time when you look back, you will understand why successful investing is easy to do but hard to achieve.