In 2020, the strategy was to accumulated STI counters which were undervalued. Against all the scrutiny and prejudice in the investing community, you would have easily achieved 15-20% with “boring and slow” stocks listed on SGX. Although you might have earned more if you manage to stick with US counters which were trading at sky-high valuations, I think STI still presents many opportunities for investors. In the coming year, I presume that STI will start consolidating at a different level rather than continue on an uptrend as the US market did in 2020. In this week’s post, I will be highlighting the strategy and perspective I will take to maximize my yields in the coming year.

Find the new consolidation zone

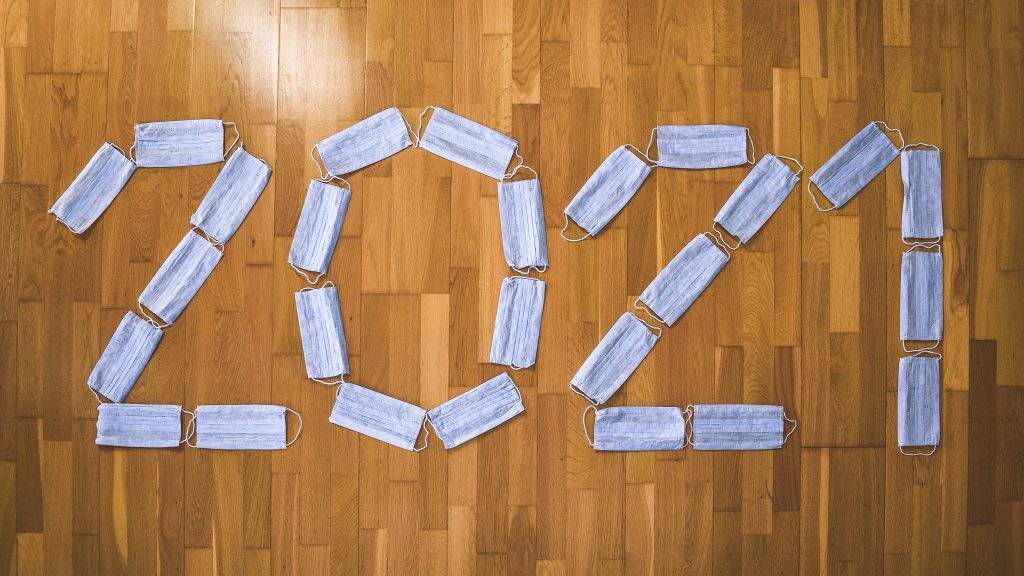

Like it or not the coming year will be another year of intense guessing for the first few months mainly due to the after-effects of the Pandemic. Basically, we are in the blind right now and no one is able to ascertain the upper limit of the index in the coming year. In the first quarter of 2021, I expect more buying and recovery as there is still some room for STI to climb before it hits pre-COVID levels. However, during those periods of uncertainty, do expect frequent and sudden episodes of profit-taking. Therefore, it will be wise to adjust your parallel channel according to prepare for subsequent quarters or months in 2021.

Expect major correction(s) to happen in 2021

The hurdles are lowered at the moment for people to regain confidence in the overall government efforts and their relief programs. That said, we will reach a point when those lowered hurdles are still too high for our weakened bodies to hop across. As more businesses fold and unemployment continues to grow in certain sectors, those worries will quickly spread and permeate into the rest of society. This will probably cause additional worries as default rates go up. During those periods of relentless and illogical selling, do take the opportunity to do the exact opposite of the market and make short-term trades to take advantage of the volatility. In addition to the worries of more businesses folding, there will also be certain shocks coming up threatening lockdowns around the world and triggering a new uncontrolled wave of selling for a brief period of days.

Singapore 2021 Budget is likely to be an expansionary budget

As a conservative nation-state, Singapore will not cease to invest in the future. This means that we can expect more capital investment into technologies that can drive higher productivity and innovation for future enterprises to operate in a competitive global market. On that note, I honestly feel that sectors that were severely downplayed in 2021 due to their insignificance and lack of growth potential (during a pandemic) will suddenly be put in the spotlight. Conversely, sectors that were given too much attention in 2021 will likely lose their shine as they are already overbought and have much lower yield potential.

Closing Thoughts

I will be sure to update after the SG 2021 budget is announced but I am confident that liquidity will continue to be sufficient to keep the economic engine going. After all, the world has entered into an era of insane money printing therefore SG will also have to step out of its conservative stance and start being more aggressive to channel overseas investments into Singapore to boost our firms and businesses.