It has been rather common to hear veteran investors make strong comments against trading and timing the market. Some examples would be hedge fund mangers saying that they have attempted both approaches and have yield better results using “patience” and “discipline” instead. To me, I feel that it will be advantageous to adapt to the market rather than using a one-size-fit-all approach.

Benefits of trading/timing markets

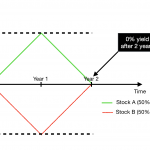

Looking at the chart above, there are technically many opportunities for entries and exits but if you just bought in and held your shares, you would have missed all the profits even if you entered and exit too early or too late. In such cases, timing the market does prevent loss of opportunity costs.

After reading this portion of the post, many will doubt that timing the market is possible. I have to admit that I fail to enter and exit at the right time as well. However, I do feel that I gain more experience, I am able to better select my target price.

Always remember that "Practice makes Permanent"

Timing the market is not foolproof

In the above Sheng Siong Chart, the price climbed almost consistently and the company has also progressed well to support the uptrend. It will be less beneficial to trade Sheng Siong than other volatile shares or shares with a annual financial cycle. That said, Sheng Siong has still been one of my counters where I trade on a yearly basis. (follow my posts for trading ideas here)

Closing Thoughts

Do not leave it to reputable experts and follow their methods blindly. They have their agenda as well when they advise us retail investors to buy and hold. One of the reasons is for prices to climb rather than fluctuate, especially if they are believers of long term investing philosophies. At the same time, I would also say that they can afford to lose opportunity costs because funds buy at a much larger margin (commissions). That is a possible reason for them to feel that exiting at a resistance might not be wise.

Again, I hope readers can consider being more reflexive rather than following conventional buy and hold methods.