Let’s face it, stock prices changes by the second and teases investors every time there is an intention to buy-in. This is partly due to the fact that each cent will add up to around $10 to $100 (for some cases), thus it is no a small matter for most of us. At the end of the trading day, the closing price of that tranche you just bought will determine if you have made the right choice to enter at that price. This is regardless of whether you caught that stock at the low of the day because so long as the closing price is higher than your entry, it would have been considered as a “correct” decision. On the other hand, investors would also end up buying in during a hype or a pump and dump which led to an expensive mistake within minutes or hours. That is why “when and what price to buy shares will be our third and last great dilemma that every investor goes through in their investment journey.

Rather plan ahead than waiting at the screen

Essentially, there is no right time when it comes to buying shares because you can only confirm if that price is really at “a low” after the fact. Thus in order to not feel self-defeat and regret, it will always be better to plan ahead and set aside a margin or error for yourself. Even though planning ahead does not warrant the lowest entry price possible, it does help to fight hesitation and regret after making the trade. Do understand that timing the market will only lead to greater disappointments over time. More importantly, maintain your composure and stay vested when you have done sufficient research and have set aside a budget for a particular stock investment. This is because investing in stocks is not for small profits but often for longer-term yield or a significant profit.

Amalgamation ON at all times

For those of us who have not already know, you are actually allowed to buy at different prices and volumes throughout the day without having to pay multiple commission so long as you have turned on “Amal” which stands for amalgamation. What this function does for you is to group up all the stocks you have bought or sold on the same day and consider them as a single order. This will help you to buy slowly if you are still unsure if the price will continue to fall for whatever reason. At the same time, you can also utilize this method to buy the cheapest batch shares on the market under “ask” before u gobble up other shares at a higher asking price. This tip is especially useful when buying shares that have a small daily traded volume.

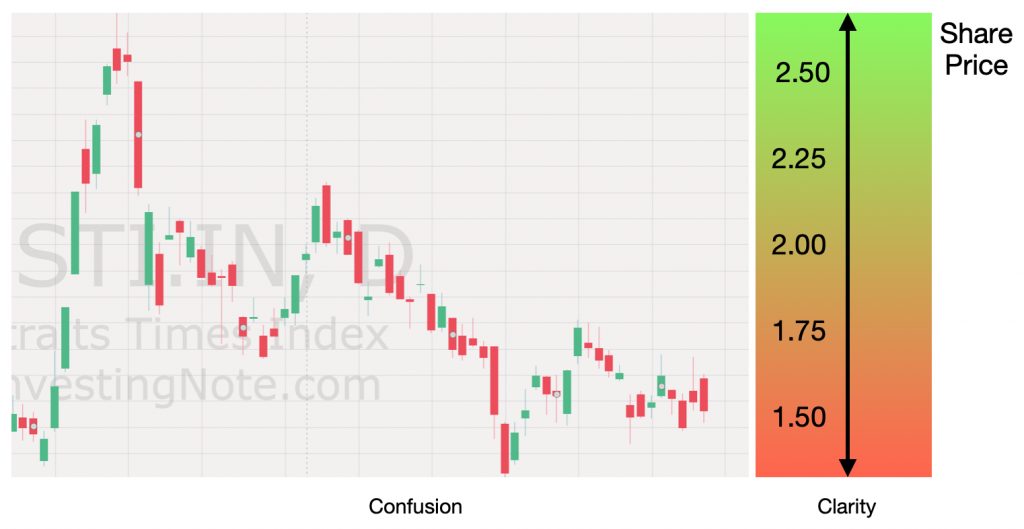

Prices can only move up or down not diagonal

It is true that prices logged overtime create a pattern such as the above with up and downtrends, but the fact of the matter is that prices are just moving in a single direction when you are looking at it in the most linear fashion possible. Thus, if you focus on the gradient colored section on the right side, you will realize that the chart can be simplified further into low to high. Having such a perspective helps investors to focus on the bigger picture instead of fixating on the minor price changes when punching in an order. Over time, prices will still go up higher or trend lower than expected depending on market conditions or misjudgment. Therefore, it would sometimes be more beneficial to simplify the way we see price differences and not conflate it with past prices or trends.

Closing Thoughts

Of the three dilemmas, I feel that the dilemma of when to buy is one which we have to outgrow as soon as possible because buying is the only way you will be entitled to yields and gains. I hope that more investors will learn to take things from multiple perspectives instead of following their emotions or short term views when deciding about something for the longer term. Learning how to make the call to buy can be daunting but facing it bravely will help you gain more experiences over time and realize that something that might matter today is not worth a second look tomorrow.

Check out our previous articles on Discounts Vs. Dividends and Holding Vs. Taking Profit if you have not already done so.