Before we go on with our rants about investing, let’s take a breather and talk about Squid Game, the Netflix series that shook the world. Anyone who has watched this series understands immediately that risk and returns are highly correlated whether it is in life or simply in a “game” like this one. Basically, for you to win the final prize, you will have to survive every game designed specifically to eliminate players like you. In short, the game is only highly rewarding because many people lost their share of the prize (because they died).

Drawing a relationship with the squid game I think we can all agree that investing is also similar because the amount gained by “winners” is determined by the amount lost by others. Many people know the phrase “high-risk high returns” and that seems to be reasonable given that higher returns are always harder to attain. That said, have we ever wondered why is that so in investing? In short, higher returns basically mean that you are willing to wait until a particular counter hits a price target that is substantially higher than your entry. Though that definition is subjective, that goal often lacks realism at least in the short term, and also subscribes to an overly optimistic view of that company and sector. Many “long-term investors” employ such techniques to bet on the futures of some companies and some of them did benefit from this technique immensely but of course, there are losers as well. Today, I will snap out of my laziness and explain why with a few simple Infographic to explain why high returns equate to higher risk.

How long will it take to recover?

A dollar less earned is a dollar lost. A little extreme, I know but doesn’t it make sense? Holding on to a particular counter that is not moving fast enough often leads to poor portfolio performance. Believing that a particular counter will eventually lead to high gains can sometimes lead to losses due to opportunity costs. For example, you might have accumulated a stock from $2.50 to $2.00 and have an exit target at around $3.00 but if the price does not go up fast enough, the $75 cents profit per share that you are aiming for might never come.

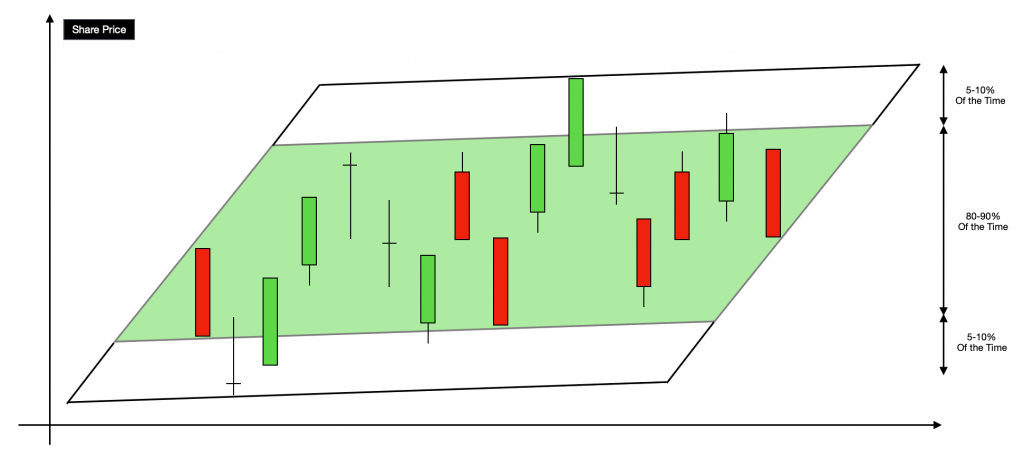

Volatility

Needless to say, all asset prices fluctuate and sometimes the actual displaced price can be close to 0%. That’s how people invest for many years and still are unable to break even. evidently, there are some stocks that are just not worth holding onto for the long term.

Shifting market trends

Your bets are based on the information available right now. This means that you will never be able to predict the rise and fall of a company in the future. Say for example Tesla has been through many issues which nearly caused the company to fold or collapse but as of today, it is one of the most valuable companies in the world. Who would have known? Basically, any investor who has purchased Tesla’s stocks right from the beginning would have sold it progressively over the years and probably abandoned all of their stock at the first sight of recovery. The insane rally of Tesla can only be explained by the recent movements in ESR investing with Tesla running at the forefront of green tech.

Closing Thoughts

Apart from the risk of not hitting our target prices, we also have to consider the potential time required before it reaches the exit price. My suggestion is to always be reasonable when aiming for yields. Do evaluate your investments and only stay with a particular stock that you feel can stand the challenges ahead as there will always be potential roadblocks for every business.