I believe many of us have attempted to do the same before. Some of us quit after a few months and some continue. My best guess for those who quit is that it does not feel rewarding. To a certain extent, it is true that tracking does not bring about any form of growth in your balance sheet. However, let me share with you my actual learnings from tracking and how it could potentially benefit you as well.

I realise the big impact of small purchases

It is easy to disregard small purchases we make especially when there is an urge to drink a nice bubble tea or watch the movie on the day of its release, meeting friends to have a dinner gathering, etc. These forms of expense if not tracked can actually accumulate to shocking amounts. I learnt about this when I realise that my expense on food was way above other necessities such as transport, telecommunications and monthly subscription payments. In essence, $3 to $6 is 100% increase in spending for one meal and $6 to $24 is 400%. The realisation does not prevent you from meeting your friends for dinner nor does it discourage you on indulging to reward yourself after a tiring meeting. All it does is basically to inform you that what you felt was small was actually bigger than you think. This will in turn change your lifestyle to better accommodate your current income level.

Income must come from multiple sources

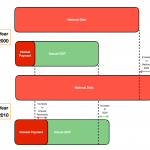

The worse feeling in life is to know that you are taxed for living. And sadly, we are all taxed for living. This means that your right to exist in the country comes at a cost. These cost include your daily expenses, non-essential expenses, upfront cost and cost for accidents. So what can we do about this tax, which we are forced to pay? Find alternative sources of income from legitimate sources. My respect is at its peak for people who work 2 or more jobs in life because they are mostly futurist and are least likely to overspend. This is because they are more likely to understand the cost of their expense more than regular salaried workers.

From that, I learn that it is not sustainable for us to only add expenses to our balance sheets and feel motivated to know how much we can save after deducting our monthly pay check. A suggestion is to find an alternative source of income which you consider as play or as something non-stressful that will encourage you to save more and spend less while living a fulfilling life.

Investment yields gives meaning to your savings

Saving money is only a means to an end. If all you can do is accumulate dollar by dollar. Whereas investing your hard earned money enables it to work for you. That growth is consistent regardless of the amount you invest as long as you do your risk assessments and plans your trading strategies. Personally, as a first generation trader/investor, I rely on my own experience to make my profits and own every bad move I make. These experience make me realise that capital growth is most of the time slow but always rewarding on a long run. Last but not least, stay away from greedy decisions and hold true to your personal philosophies in investing/trading.

Closing Thoughts

Keeping track of your income, expenses and investment yields make you a truly financially savvy person. This will not only benefit your capital growth over the long run, it will also help you understand how to face your current circumstances.

Dont’t like where you are right now after tracking for a year? Be the change that you want to see happen in your life.

ME