Growing up in Singapore, I began to realize that there are some banking outlets that seem to have a more premium touch to their designs. Apart from that, it is obvious that you are only welcome if you belong. This is much like a country club membership if you like. These Privileged banking outlets serve clients with an obvious higher net worth thus there is also greater dedication and personalization in their services. In this post, I will not be comparing privilege banking accounts and their basic requirements of a few hundred thousand dollars. Instead, I would like to share my personal experience as an average Joe in Singapore (i.e. not born in a wealthy family) of such services and why it was my goal to have such an account at all.

There is a difference in treatment (for obvious reasons)

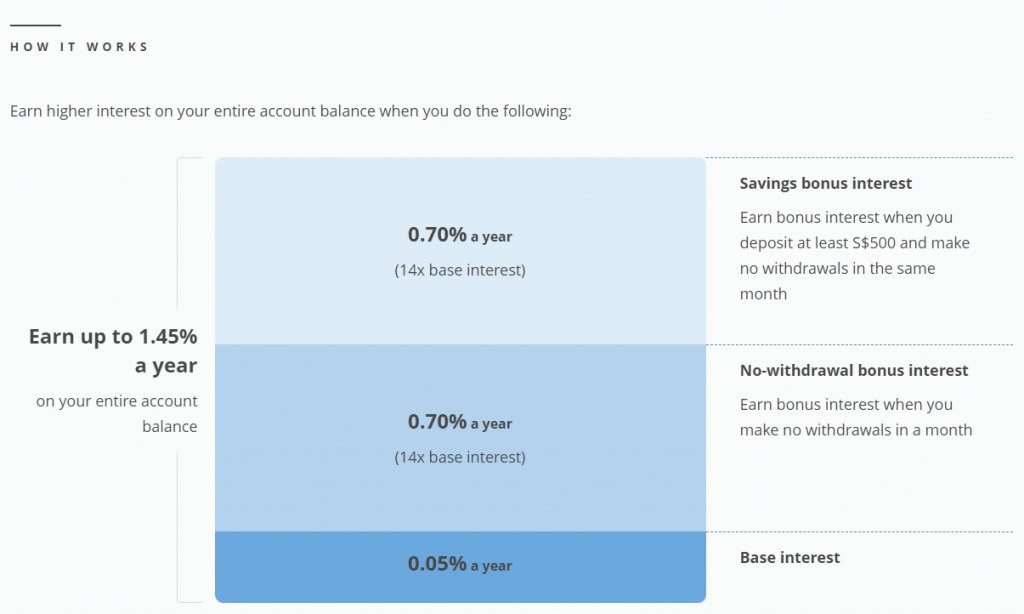

I would like to use OCBC’s Bonus plus vs Dividend Plus account as an example. For starters, both accounts have a similar structure, however, the interest rates of both accounts are obviously different. Granted that the conditions are different because the Premier Dividend Plus account requires much higher minimum balances and monthly deposits. But the fact that there is yet another minimum $200k balance required to join OCBC premier banking and a minimum of 50k in this particular account in the first place, shows its exclusiveness. Take a look at the screenshots below from OCBC’s website.

Premier Dividend Plus Savings Account (OCBC Premier Banking)

Bonus Plus Account (OCBC Personal Banking)

Apart from this distinction that is available as public information, I am sure there are other perks and exclusive deals for premier/privileged banking account holders.

A possible financial milestone

Frankly speaking, most of us operate based on setting and achieving goals. Without such structures, it is hard for us to imagine the “finish line or pit stop” in life. In this case, we are referring to our financial journey. Therefore, aiming for a privileged bank status is a possible financial milestone for some of us. This might be seen as shallow or even sometimes wrongly judged as a means to flaunt one’s wealth. That is why this milestone should go no further as a personal accomplishment for oneself and nothing more.

Social Mobility as an end in itself

Though it is not an achievement for many to join privileged banking, it is definitely not easy for one person from a modest background to gain access to a “privileged” status. While I do not support the idea of flaunting one’s wealth, it is not wrong to aspire to have more in life. The point I am trying to make is simply based on the idea of “having a choice” and this is certainly not a choice for some especially if they were born into wealth. Hence, I do feel its fair to treat privileged banking as a goal in one’s financial goal. More importantly, to ensure that one does not beg, borrow or steal to attain this status.

Closing thoughts

This blog was created to help more people achieve social mobility in terms of finance. Thus we will not stop at helping more people learn about money management and growing one’s wealth. This is because we will inevitably lead people to want more money simply as an end in itself. However, we still need to identify possible milestones for ourselves to evaluate our progress as well. I hope that more people will consider their own equivalent milestone in their own financial journeys. But as always, stay hungry but never proud.