Might be a little early for now but most investors are still overly fixated on the fact that the economy is close to stalling during this period of circuit breakers and lockdowns. Essentially, markets will rebound when things return to normalcy. Hence, we have to be prepared for the upturn as well. In this post, we will be focusing on inflation data and government spending during this Covid-19 pandemic to understand how the markets will turn out in the future.

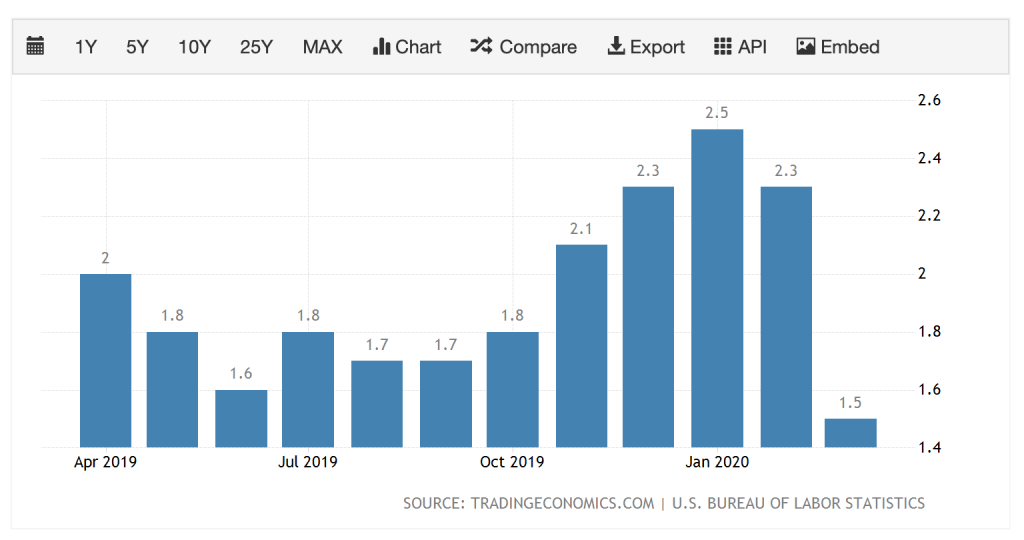

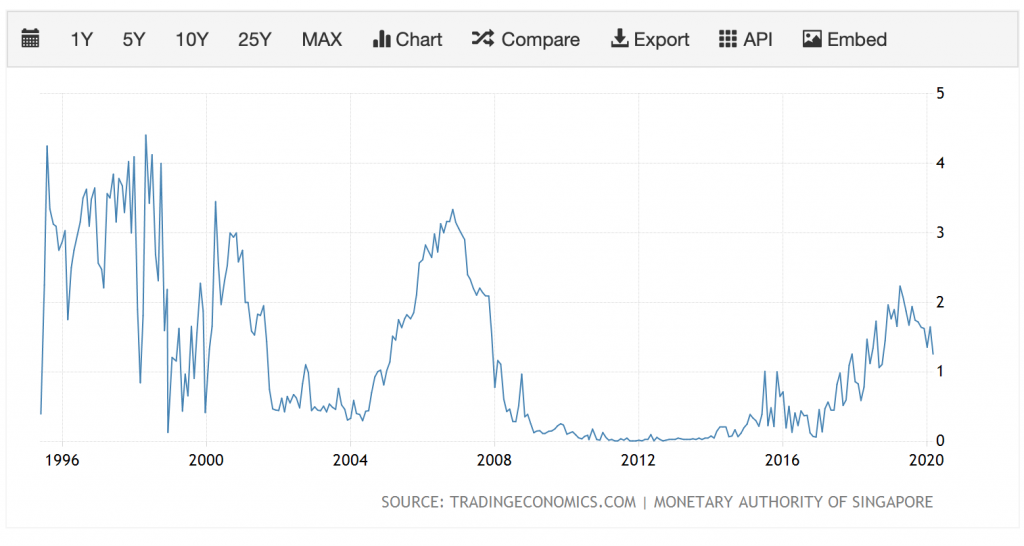

Inflation data from both US and SG (Notice the drop inflation despite massive government spending)

In recent months, many central banks around the world has been printing massive amounts of money to support their economies. As such, the markets are flooded with cheap money disbursed by the banking system as loans to organizations, small business owners, and individuals. These fresh funds entering the markets will inevitably cause some level of inflation in the economy, however, those impacts are muted due to the decrease in consumer spending. Therefore when the economy restarts, excess cash disbursed when the economy stalled and the resuming of consumer spending will likely cause a spike in inflation all around the world. For many, this will mean an increase in prices for all goods and services however for investors, it will be positive for a spike in revenue and potentially higher net profits in the coming quarters.

Potential Fiscal Policy and its reaction

After resuming to normalcy, the economy will tend to go into a frenzy in terms of spending. Therefore, there is a likelihood for interest rates to go up when the pandemic is under control. Many individuals might also reduce their spending especially if they are under additional debt loads due to the pandemic. But overall, consumer and corporate spending will still spike and companies will have to entice more consumers to switch services and brands to their advantage in that window of recovery.

What this means to investors is that companies that have a good track record in terms of services and brands will likely gain more market share. This is on top of many small competitors downsizing or closing during the difficult periods of the pandemic. As a result, lesser competition along with a rise in spending will benefit companies in their Quarter to Quarter growth and cause an increase in investor’s interests as well. Lastly, with the increase in interest rates, we can also see a spike in bank shares as their net interest margins will also increase substantially.

Preparing for the upturn

With the above information on government spending, inflation, and fiscal policies, there is an expectation that indices will eventually go back to 40-50 points on the monthly RSI. This means that many shares will move away from oversold territories as well. As such, we refrain over exiting the markets too frequently without a sound strategy to remain vested, otherwise, you might be left behind once the upturn comes. This is crucial information especially for traders who are inexperienced because they tend to exit too often. It is ok to pump more in to exit for small profits. but do not enter and exit entirely. In other words, it is ok to let go of some profits.

Many speculators have been saying that the impact on the market will last for more than a year and some even said that the markets will result in an L-shaped curve meaning that there is little to no upturn. On that note, I would like to emphasize that there is no certainty for the eventual shape however staying vested is still key if you are able to hold more capital in stocks.

Closing Thoughts

The markets now are still confused and many investors are still puzzled by the unnatural recovery of the US market. Granted that trillions of dollars have been pumped into the market to cause an artificial rally but eventually, companies will be reporting lower revenue because of the pandemic and that might sense a shock wave to investors. Hence we must still exercise caution in our strategies. It will still be wise to invest in companies that are innovative and resilient amidst the crisis and also look out for companies that have the potential to bounce back in the future.