Many important decisions are based on short term benefits because most of our world leaders and business giants have a limited tenure. This in turns incentivise leaders to borrow more money to stimulate growth and business expansion so that their overall revenue and profits will continue to increase during their leadership. But at what cost? The general consensus is that the debt will be ‘paid’ by our future generations. However, that does not deter more borrowing and rising debt levels.

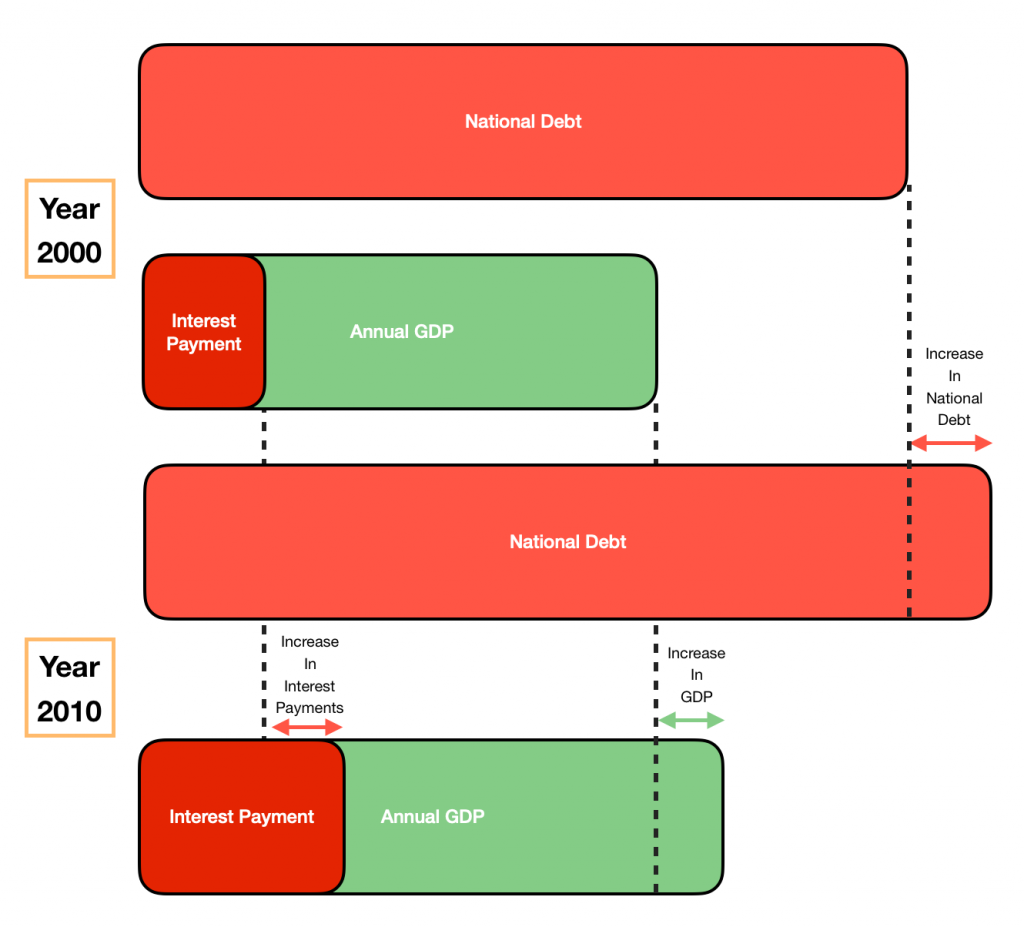

Looking at the above charts, we can see that rising national debt will eventually cause annual budgets to lessen despite net GDP growth over 10 years. Thereby bringing us to the topic of how this can affect us and our future generations. With this understanding, I would like to expound on the fact that many high revenue and high net profit generating companies might be at risk in near future.

Future growth at risk due to unsustainable developments

Firstly, growth rates are relative to previous year or quarter’s performance. Prolonged growth at a fast rate will inevitably cause future perfromance to appear flat or even negative. Knowing that the markets are often reactive towards quarterly reports, unsustainable growth might lead to sudden price dives.

Secondly, since all growth comes at a cost, if the growth in revenue does not over take capital expenditure, the company will actually have issues sustaining day to day operation costs. As a result, businesses might have to suspend operations and decrease number of employees. Such news are often highly detrimental towards investors’ sentiments.

Limited resources for future generations

All forms of growth comes as a cost of resources and capital. While we usually focus on capital expenditure, we also often neglect the actual resource utilised for the expansion of a business. Apparently, sustainability is an issue to many businesses contributing to negative environmental impacts. For example, the issue of global warming has long been alerted; however the actual effort put in to alleviate the problem is still less of a priority for most companies.

As such, I believe that companies which are expanding with little consideration for the environment will actually be facing the burn in near future. With new environmental laws and taxes, companies that have been neglecting these aspects will have to pay hefty costs. This is especially prevalence in developing countries who are more concerned about cost savings rather than the environment.

Longer recession in the future

When debt levels become unsustainable and the country decides to go into recession, countries are forced to cut spending drastically and increase borrowing rates. The result would be much higher unemployment and shrinking of the economy. Also, the reboot duration will be longer and it will be cause lasting negative impacts on the lower strata of society.

Closing Thoughts

With the worrying debt levels of the major economies such as US and China and consequently many companies, it would be naive to think that the debt will not affect the future. Many countries should have cleared their debt along the way if not for the rat race between countries. Personally, I feel that the debt levels can also gain more allowance as the core currency inflates, but more importantly, when will the next global recession take place? My take on the matter is clear, the earlier the better.