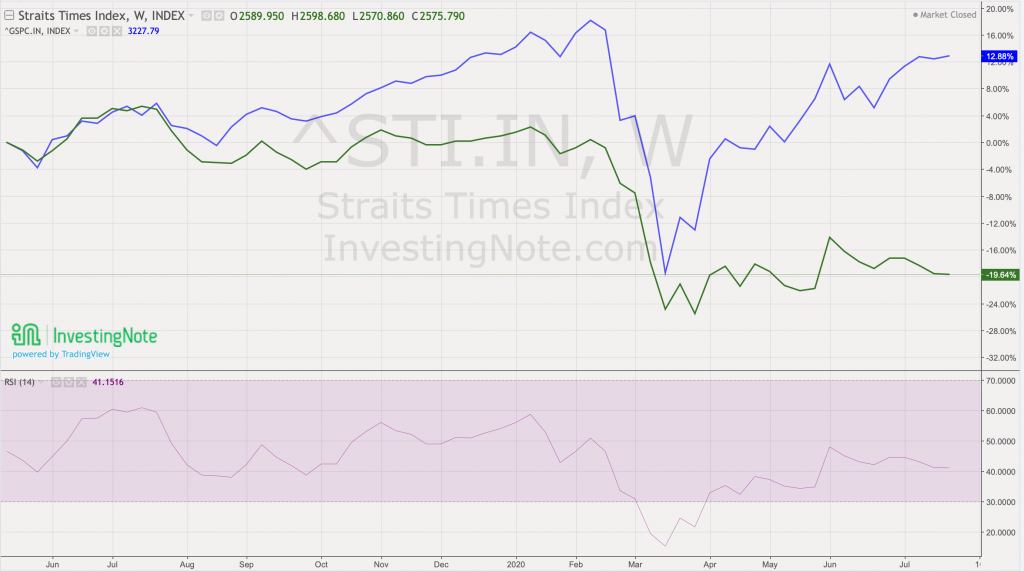

STI has been a severe disappointment ever since US climbed from the lows of 23 March 2020. However, the reasons behind this weakness is understandable because Singapore’s market is way smaller than the US’s market. Additionally, Singapore’s index is weighted heavily on companies such as banks, telecom and real estate businesses. The value of banks (more than 35% of STI) is significantly lower when interest rates stay low to cushion the blow of the pandemic. As such, we are currently experience a prolonged horizontal consolidation phase as our interest rates continues to stay low until more business are able to get back on their own feet. In this week’s post, we will be diving deeper into issues related SG’s recovery in the coming months and why is STI not experiencing the same rally as the US.

Money printing and share buybacks

After my post in November 2019 (US and SG market detached), STI has retreated alongside US indices when markets crashed in March 2020. According to the daily chart comparing both STI and S&P 500 (GSPC), it is observable that STI is going sideways while GSPC has been climbing back to preCOVID levels. Coupled with less regulation on share buybacks, the US pump a great deal of money to prevent its bond markets from collapsing. If you have been following the news, US T-bill’s 10-year yield was falling steadily as capital rushed to seek refuge. However, due to the massive money printing and share buybacks, yields did not return to pre-COVID levels like the equity market. This is because investors are assured by the feds that their repo operations will not cease to support the economy.

STI & GSPC Major components react differently to low interest rate environment

STI didn’t recover mainly because the majority of its 30 components are reliant on healthy consumer spending and cross-national trades and transportation. Furthermore, the low-interest rates also prevented banks from earning healthier margins from their loans, which also resulted in lower savings account interest rates. Conversely, US major components like FANG, are tech companies that can spend the cheap money disbursed during the crisis to reinvest in their companies via, R&D and share buybacks. That is why the US is outperforming SG by a huge margin at the moment.

STI main support level (38.2% confidence level on monthly fibo chart)

In the case of a massive catastrophe stacking on top of the pandemic, STI will fall back to the next level at 2434. Bearing in mind that STI did cross that support level for 4 days in total before heading back quickly above 2434, signaling the reliability and strength of its support. Do expect STI to hover around this green zone before heading back to the light blue zone when the pandemic is under control (start of vaccination) and when global travel and trade returns to pre-COVID levels.

Closing Thoughts

Relative to US market’s, STI is not underperforming because its conditions for recovery is determined by different factors. As a matter of fact, I would argue that STI consolidation at the moment is a genuine opportunity for companies to stay grounded and innovate before a rally occurs like in other countries. This will provide Singapore businesses with an added understanding of the severity of the matter as reflected on STI.