As of 2nd June, STI has finally reentered the Bollinger bands of the monthly chart, while this might seem trivial during normal times, STI has been kept outside of the lower limits since March of 2020. So essentially, the market is responding optimistically to the end of the circuit breaker as Singapore proceeds to phase one as they restart the economy. At today’s closing, we can see that some of the STI components are up roughly 5% and the triple top formation was broken with a solid green candle on the daily chart. In this post, we will be covering some strategies to accumulate shares during an upturn. Bear in mind that we are not suggesting that it will be a continued upturn, however, it will be useful to strategy and plan ahead when the market is bullish.

Set price targets at resistance turned support levels

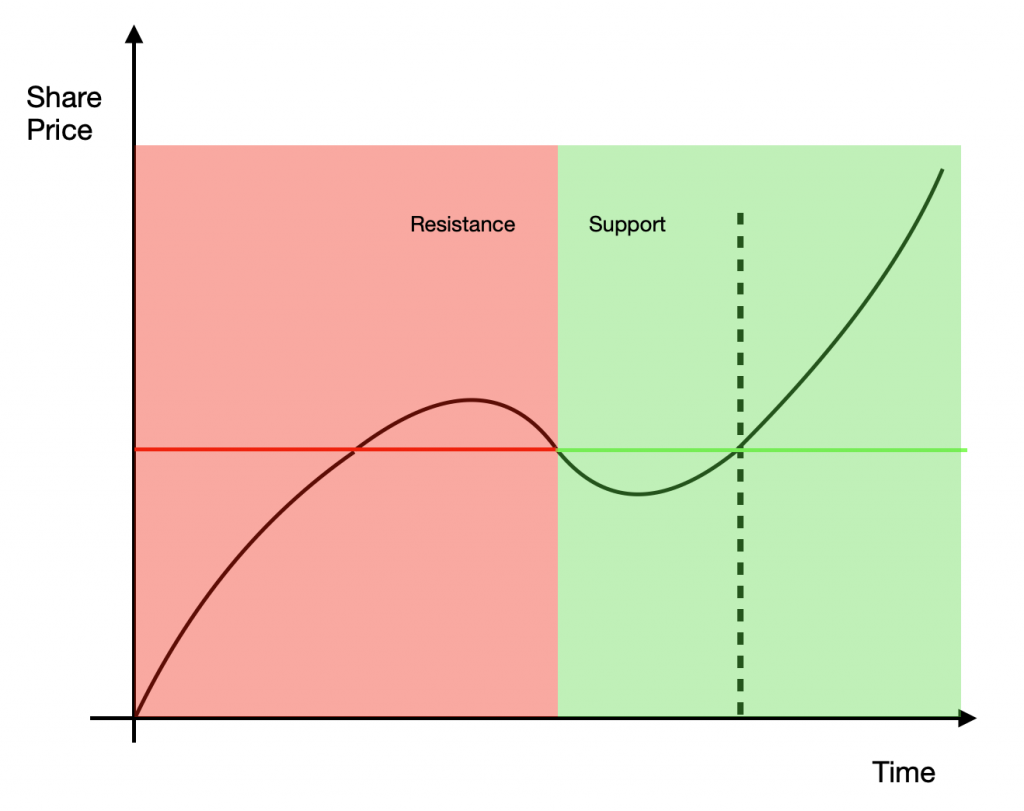

The tricky part about buying shares during an upturn is to identify if the price u are buying at is closer to a support or resistance level. The difference is small however the eventual price movement might differ significantly. In this above sample chart, if you would have bought at the red area, there is a chance for the share price to retreat after bouncing at the resistance level. However, if you would have bought at the green area, there is a higher likelihood for the share price to not go below the resistance turned support level.

Look out for rate of recovery

If only life was like a “fast and furious movie”, unfortunately, the reality is way more unexciting than we would like it to be. This includes sustainable price rallies. This might somewhat ring a bell to last week’s post which covered sustainable price rallies but in today’s post, the point to note is to only buy when the price is not on an aggressive rally that might turn out to be a price trap. Take a look at SATS’s chart in the past few months, as there were two occasions whereby the share price climbed almost 15% in a day only to retreat to original or lower prices the following day.

Prepare to pay a higher price after each tranche

I left the dollar cost average (DCA) as the last point because although DCA is easy to understand but it is never easy to perform. Regardless of bear or bull conditions, it’s never easy to buy and accumulate when there is an uncertainty that the price might drop (when averaging up) or drop further (when averaging down). Therefore, realistic plans should be made in advance for future executions. Some people might ask why not just buy as low as possible and be a value investor. My response to that would be that we will never really know how low or how long it takes for the share to climb but will know how to adjust our expectations based on the signals provided by support and resistance. This is so that we can have the option of navigating the waves of volatility with entries and exits rather than riding the waves and only securing the eventual price displacement.

Closing Thoughts

Needless to say, in every strategy, there will be some level of discomfort and uneasiness when some parts of it do not make full sense and sadly these are feelings that investors must endure in order to stay active in the market. Through this post, we have covered the importance of buying at the best possible entry points, recognizing actual bullish situations from bull traps, and lastly to prepare ourselves to average up during the upturn. These techniques will help minimize risk during an upturn while at the same time maximizing returns.