According to SGX sources, the Straits Times Index is by far the best performing index in the month of March 2021 and that’s really interesting. However, we do know that other markets are cooling off at the moment after they miraculous ascend in the 4th quarter of 2020. This leads me to wonder about the fate of STI when other markets restart their bullish engines. That said, investing is not about guessing what is going to happen next but to take action whenever opportunities arise. In this quarterly review, I would like to pen down my thoughts about some salient trends happening within STI and how I would be positioning my capital in the following months.

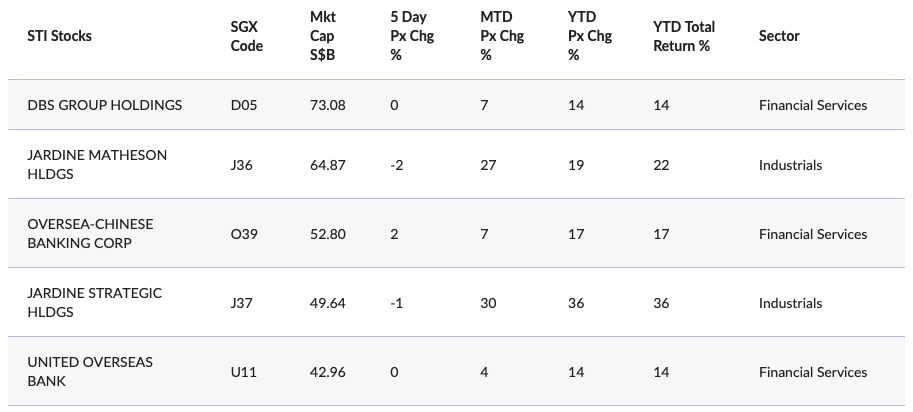

The banks led the way but seems to have lost steam to head northwards

Our 3 banks, DBS, OCBC, and UOB led the way for Singapore to break support at 3000 in 2021 and continued to push the index toward 3130 before other counters joined in. Needless to say, the market feels that the banks in Singapore are probably near resistance and therefore buying pressure is no longer sufficient to push prices higher for the time being. Personally, I am no longer interested in the banking sector at the moment due to its high valuations. As interest rates continue to stay low, I will probably wait for a significant correction in the sector before deciding to hop back on board.

Investor Friendliness Index

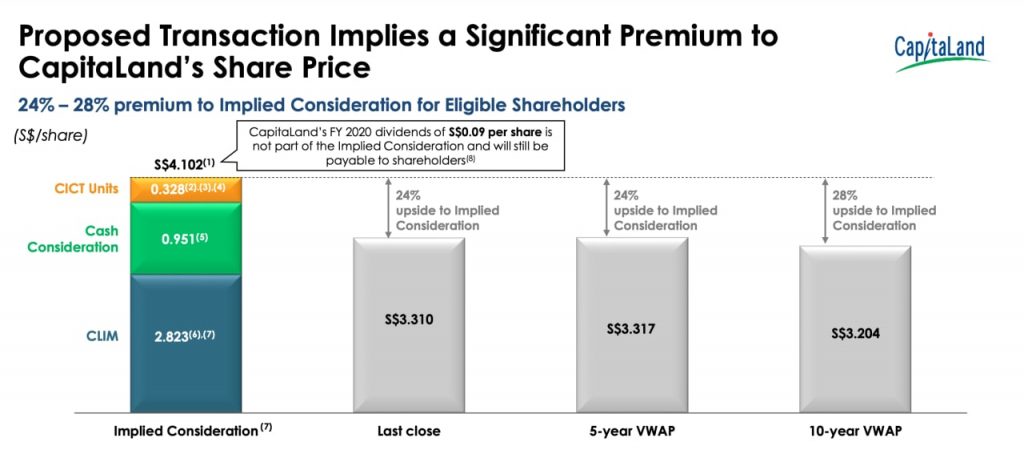

Let’s be honest right now, how many of us anticipated a delist offer from Capitaland? I would argue that few people would be able to say that with confidence and action. Capitaland’s delist offer threw many investors off as the share price post-announcement fell from $4.01 to $3.70 which led to a tonne of negative comments about the offer from retail investors. That said, the announcements from Capitaland really jolted the market with a new wave of confidence for large companies in Singapore. For the longest time, many large counters in Singapore have been consolidating which made many investors lose interest in Singapore companies. This bold move to help investors unlock value and get a significant premium for their holdings might just be a beginning for other large companies to restructure and present opportunities for investors to reallocate their capital.

STI’s next quarter

While I do expect a correction coming soon, I do not expect a huge dip happening in 2021 for the STI because we have proven to the world that our domestic economy is resilient to a certain extent and our Government is forward-looking enough to spur growth in sectors that are still on the rise. Additionally, our GDP rebound from last year’s exceptionally poor performance will also be a significant booster for investors searching for stable yields at a reasonable valuation. Personally, I would be holding for the time being until a larger reaction or trigger emerge. In the meantime, perhaps the best move is to wait for more positive news to come and dividends to be paid out in May and June.

Closing Thoughts

STI’s performance so far has been great but others might argue that the recent rally is way overdue, which might be true to a large extend. Moving forward, I am positive that investors will start adjusting to the post-pandemic market conditions in Singapore. That will mean less volatility and therefore lower trading income but with more restructuring potentially happening, perhaps holding might yield the greatest returns.