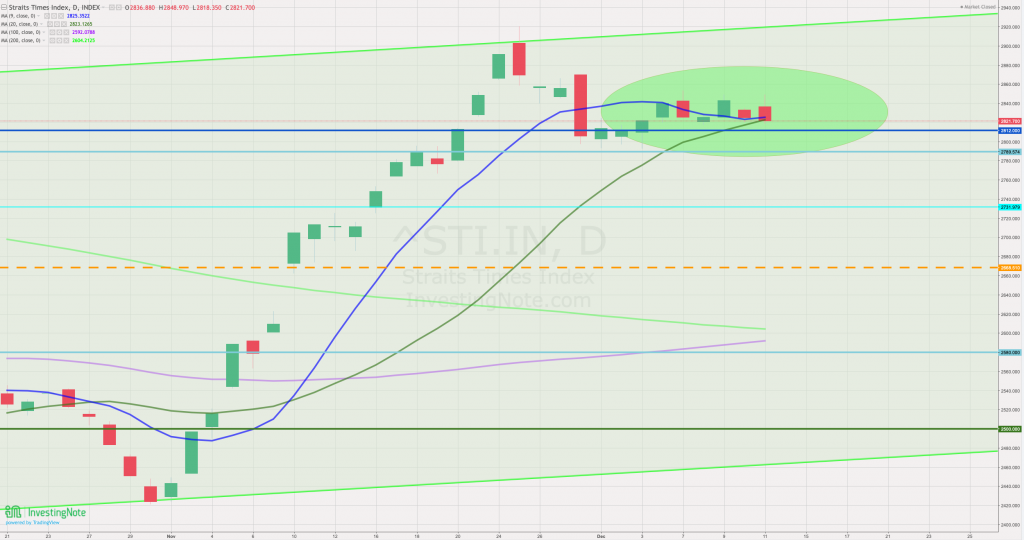

Will 9 days MA bounce or break? (w.r.t 20 days MA)

STI is acting up because the euphoria of a holiday celebration ahead is starting to challenge the worries of the second and third waves of infection around the world. The silver lining of the matter is that Singaporeans are spending aggressively and keeping most businesses optimistic at least in the near term. However, if this goes on, many investors will start pricing in the longer-term reduction in revenue due to a reduction in international visitors in Singapore.

That said since STI is nowhere near pre-COVID levels or around 3000-3200, we can safely say that the optimism in the market is not overly extreme, whereas it is still considered rational and thus there is little concern for the market to go back to the bottom in end October 2020. Right now, you will see that counters in STI are starting to act independently unlike in the past weeks because not all counters rose to their supposed peaks and for those that did, they are still consolidating at the moment or are retracing to a more reasonable price level.

STI – Updated Daily Chart

This graph was anticipated ever since there was a relentless climb in the first 2 weeks of November. Right now, the market is still by and large undecided thus will continue to consolidate. As the 9 days, ma approaches the 20 days ma, I expect both MA to cross momentarily at least otherwise a retracement back to key support levels is possible as well.

STI – Updated Monthly Chart

On the weekly chart, STI is still balancing right in the middle of the two other boundaries. Hence we are unable to tell if the market is leaning towards a more positive or negative outlook from the fib retracement levels. As mentioned earlier, I do hope to see a bigger reaction in the market, by which I mean either a sharper dip or a spike to know if I should continue selling if the prices go up or buy if it goes down. Regardless of the market’s reaction, I strongly advise my investing peers and readers to stay calm and not overreact in the current situation.

Author’s Call as of 13th December 2020

- The hype is dying off but there is little reason to feel a big sudden drop as STI is still lower than pre-COVID

- Holiday mood around Singapore is boosting certain counters but the uncertainty remains for counters relating to international visitors

- 9 days MA likely to make a sudden move in the coming week but there is little reason to think that either direction is more likely

- Many counters in STI are starting to move in a non-uniform manner meaning the recovery of certain stocks are likely to be genuine

Author’s Call as of 6th December 2020

- STI bounced from the resistance turned support line at 2812

- The further postponement of the travel bubble was probably counteracted by the hype from the SingapoRediscover voucher

- STI might be boosted by the news from Singtel-Grab full banking license, SATS has also exercised the option to raise more money

- The monthly chart suggests that there is still a lot of room to climb for the index (in the long run)