After a small scare, time for a rally but how long will this rally last?

STI has been widely known as a sleepy index for the past months. Basically, as a trade reliant nation with a insanely small domestic market, it is no wonder that STI is lacking behind other major indices with larger markets. However with lower daily reported infections and resuming of work for the migrant workers, Singapore is beginning to restart its economic engine for real. Also, after all our disappointing 1H reports are out, investors are feeling the bottom as well because the positive impacts of government subsidies has lessened the losses of businesses by a significant amount. Lastly, we anticipate another hype in the market as the government will be announcing another stimulus package to extend existing measures to support businesses affected by the pandemic.

STI – Updated Daily Chart

STI is still edging upwards from last week’s minor bounce. at the moment STI is resting above support level 2580 but is still some way below the parallel channels above at around 2640. Both 9 and 20 days MA are showing signs of convergence, which is a positive signal for investors.

STI – Updated Weekly Chart

Last week’s closing showed that STI is moving away from 2533 support level. Though its progress is still slow, we can expect STI to continue its trajectory towards 2700 level at its fibo resistance. The light blue channels above is weak because the descent was too fast and sudden due to the pandemic. Hence, investors should continue to accumulate as STI’s recovery would similarly be much faster once it returns to the light blue zone.

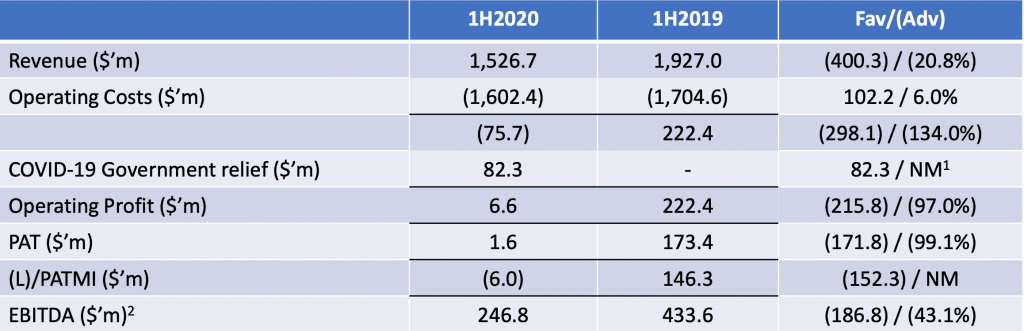

Special Feature – ComfortDelgro (C52)

Essentially speaking, ComfortDelgro (CDG) is prepping for a potential recovery after a long descent. As investors, we must remember the significance of public transportation and taxis in the country. Yes, the pandemic has reduced ridership by a large extend and recent government subsidizes did not prevent the company from going into the red. However, ridership has recovered to 70% relative to pre-COVID times hence it will be wise to start buying this counter before confidence returns, especially when work from home arrangements reverts.

Author’s Call as of 16th August 2020

- STI closed above support levels on both daily and weekly charts and is edging upwards

- Next (5th) stimulus package to be announced on Monday supports recovery of companies

- Major components of STI has reported their 1H performance and are all within reasonable expectations

- Look out for bullish price actions in the coming week to seek if next resistance level to take profit if your position is for a short term trade

Author’s Call as of 9th August 2020

- STI was supported again by 2500 and is currently supported by buying pressure for bank stocks

- STI closed resting above 9 days moving average but Friday closed on a red

- More companies have reported their performance for the 1H of 2020 and they are generally within expectation

- STI will likely continue an uptrend as more people buy bank stocks for the August Ex-Div however it is uncertain if that uptrend will go back into the parallel channels.