STI tracked the US market retracement

This retracement certainly came as a surprise as we did anticipate and got an expansionary budget supporting Singapore’s financial system as well as struggling businesses. However, we still witnessed a minor contraction from Wednesday onwards and the fear right now is how far would our index go? In this week’s market outlook, we will identify a few key support levels to take note of if the retracement extends in the coming week. Otherwise, we should be able to see a rebound in the global market unless another trigger is announced with severe negative impacts on the world economy.

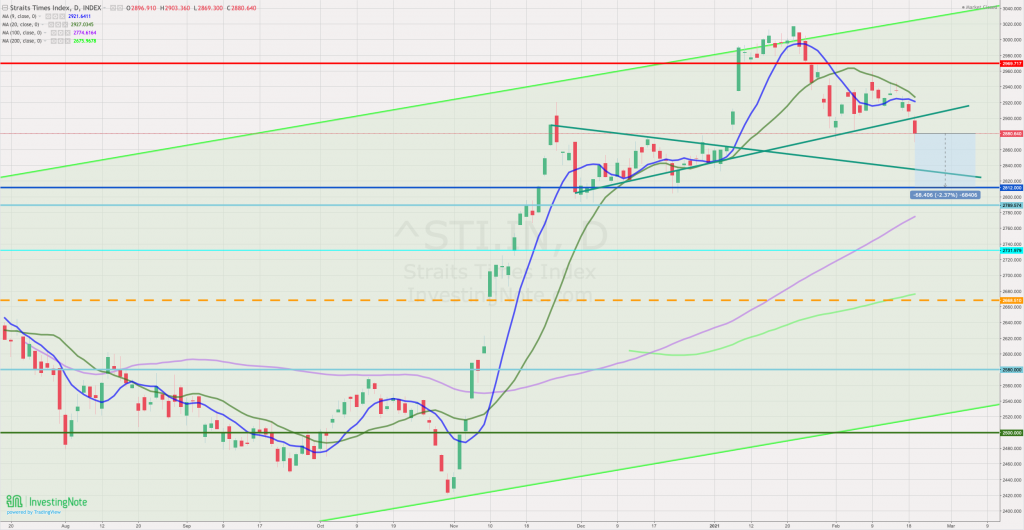

STI – Updated Daily Chart

The daily chart of the STI closed below the support level identified by the green line drawn on the screenshot above. The next identified support level was used to demarcate the crisis level which the STI broke on the 21st of November 2020. This support level at 2812 will be the next level which we will be looking at if the retracement continues globally.

STI – Updated Monthly Chart

On the monthly chart, the STI is retreating back to the 20 months moving average, which it has been kept under since May 2018. Thus we can say that STI is also encouraged to retreat due to this significant resistance level. For now, I think we should reconsider accumulating if you have let go of some of your holdings in recent weeks, otherwise holding, for now, might be the best option.

Author’s Call as of 20th Feb 2021

- Global market retracement triggered by the US market

- STI was not bolstered by the SG budget yet again and have gone under a key support level on the daily chart on Friday

- The monthly chart also points towards the same direction as STI tried to break out of 20 months moving average in January

- MY suggestion is to monitor and plan ahead if you have sold some of your holdings in recent weeks to take profit for reentry.

Author’s Call as of 14th Feb 2021

- The index is still stuck in the small gap formed in early January 2021

- Company financial reports set the tone and brought a heightened level of realism for investors

- The overall sentiment is positive on the market but the economy still struggles to show clear signs of recovery

- The STI might try to climb back to 3000 levels in the near term to retest the resistance level