Vaccine “fever” coupled with index wide recovery excite investors

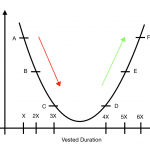

Instead of explaining the obvious for why the uptrend continues last week, I think right now investors should be seriously considering their next moves. At the moment, we have just arrived at the same exact level in June when the state of Euphoria misled investors into believing that it was U or V-shaped recovery. That said, analysts have already predicted an L or rather K-shaped recovery since the start of the crash, therefore if all goes well, we can expect this to be the legitimate recovery rally. Needless to say, last week extended the rally and almost all counters in the index benefited from the 2nd effective vaccine news along with the US elections confirming that Biden will become president based on the number of electoral college vote numbers.

STI – Updated Daily Chart

On the daily chart, STI managed to overcome multiple resistance levels convincingly. This is in spite of many retail investors aggressively taking profit in fear of an impending correction or a pump and dump situation for certain counters, However, the market remained resilient with some counters closing at the week’s highest price. As for the moving averages, the 9 days moving average has successfully crossed the 200 days moving average thus extending the bullish signals on the daily chart.

STI – Updated Weekly Chart

This is the second time STI 9 weeks moving average has crossed the 20 weeks moving average. After 5 months of sideways consolidation after June, STI is finally manifesting a K-shaped recovery. This is a sign of the 3 banks recovering really well in expectation of less liberal interest policies from Biden’s presidency.

Author’s Call as of 22th November 2020

- STI’s immunity to the worries brought forth by second and third waves of infection is apparent at the moment

- Based on the moving averages STI is still showing positive signals for its extension of this recovery rally

- Domestic spending proves to be significant even for tourist-centric businesses

- The healthy expectation of air-travel resuming continues to boost investors confidence

Author’s Call as of 15th November 2020

- STI massive spike is a sign of stocks regaining value from the oversold state

- Some counters are riding on the market’s euphoria and will not be sustainable

- Trump’s reluctance to concede the White House is slowly the rise of the index as well

- Objectively, many companies are still in a weakened state and the news is still trying to point to the severity of the pandemic for obvious reasons (newsworthiness)