Triple Top Formation – Lookout for increase in volume at support (2500)

Currently STI has formed a triple top formation and the psychological support at 2500 remains intact at closing. If there is further weakness spotted at market opening on Tuesday, this might lead to a downturn. Do note that if US-China relations continue to go south, then STI might extend its consolidation or follow suit into yet another downturn. However, this triple top formation is on a daily chart so there is chance for it to be inaccurate.

STI – Daily Chart

Looking at the daily chart, we are currently at the mercy of the US trading outcome on Monday. If there is a severe weakness in US markets, STI might lean towards downtrend rather than attempting to breakout at 2580. Do check out previous STI market outlooks to have a clearer picture of why it has been consolidating.

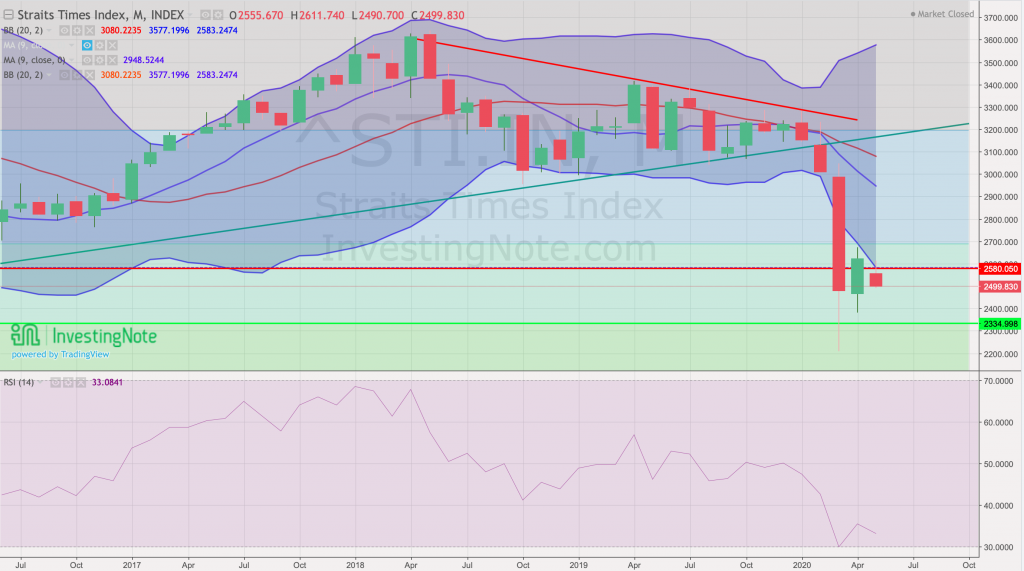

STI – Updated Monthly Chart

STI is at the state of indecision, there have been multiple attempts to break out of the lower limits of its monthly Bollinger bands, signifying that it has not gone anywhere near the state of recovery. However, with the good news aligned in the coming weeks, we can expect some investors’ confidence to return and potentially pushing it back within the Bollinger bands.

Author’s Call as of 24th May 2020

- STI might break support at 2500 (following its triple top formation)

- SG circuit breaker is ending on 1 June explaining STI’s indecision (parts of the economy reopens)

- Look out for Tuesday morning’s reaction on STI to decide if you should enter the market

- Look out for counters in STI that have shown resilience in its business but weakness in market sentiments for the best value over time

Author’s Call as of 17th May 2020

- The market is cooling down and bears and coming back into the picture

- The US might inject more stimulus in the economy and for its people

- Supply and demand shocks continue to haunt the global economy

- SG has stabilized community spread and will resume businesses in the coming weeks

- Buying in bulk is highly discouraged at the moment and there is reason to believe that markets will consolidate for the coming week.