STI’s lack of tech companies has a silver lining after all

Last week’s US NASDAQ and Hang Seng Index dipped significantly due to the sudden jitters about the obvious tech bubble that has been upheld by wishful investors trained by the ridiculous rallies since 23 March 2020. Charlie Munger’s recent comment about online trading platforms came in at the right time suggesting that small-time investors supported by social media underestimated the risk attached to investing. Before this bubble started to pop, I was thinking that if there was a prolonged rally for those popular counters, once profit taking starts, those pseudo investors will start averaging down aggressively, therefore, risking their “hard-earned” gains during a downturn. The situation is accentuated by leveraged traders who have been trading with credit as they might default on their loans and expenditure causing stresses on the financial system. Circling back to STI, we should be glad that our main counters are non-tech companies hence we should be less affected by the shock to the global tech stocks.

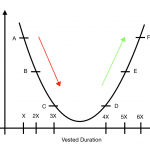

STI – Updated Daily Chart

On the daily chart, STI appears to stay positive at the moment despite the massive dips in the global indices. At the time of writing, there is a sign of slowing on the NASDAQ in terms of its descend, however, the VIX has risen back to around 28 points, signaling that US indices have yet to stabilize. In the coming week, we will be able to see if STI’s resilience was temporal or will it sustain.

STI – Updated Monthly Chart

Perhaps our slower recovery does have a silver lining after all as we are still heading north for the time being. Up next, STI will be challenged by the 150 months moving average and there might be some level of resistance when it surpasses that level. In any case, we should still watch other major indices to see if their corrections are lessening or widening before we decide on our next move in the market.

Author’s Call as of 27th Feb 2021

- Tech stocks finally started their descend after a prolonged rally and euphoria over the past months

- The STI’s lack of tech counters displayed resilience during this particular correction

- Both daily and monthly chart shows that STI is still in the green at the moment however this situation might change

- Profit-taking will continue to take place as STI counters hit their own resistance levels

Author’s Call as of 20th Feb 2021

- Global market retracement triggered by the US market

- STI was not bolstered by the SG budget yet again and have gone under a key support level on the daily chart on Friday

- The monthly chart also points towards the same direction as STI tried to break out of 20 months moving average in January

- MY suggestion is to monitor and plan ahead if you have sold some of your holdings in recent weeks to take profit for reentry.