US infection cases increases, short selling increases, is STI implicated?

We can be certain that STI will fall because of the shaken markets in the US indices, which have fallen back to close to 3000 levels (critical support). However, the issue right now is how affected would STI be in the coming week, and will it take the opportunity to retrace back to 2500-2550 or proceed to climb higher? My take is that STI has already be excluded from the recent rallies therefore we should be only experiencing a minor fall in the index. Otherwise, STI might be in for a further downtrend if the support at 2500 does not hold.

STI – Updated Daily Chart

STI has not sustained its position in the middle of the parallel channel. At the moment, it is likely for STI to head down to the light green line before bouncing. Also, since STI is at the mercy of global markets, we should expect at least an attempt to break support due to the rising fears of second waves of infection in America and China.

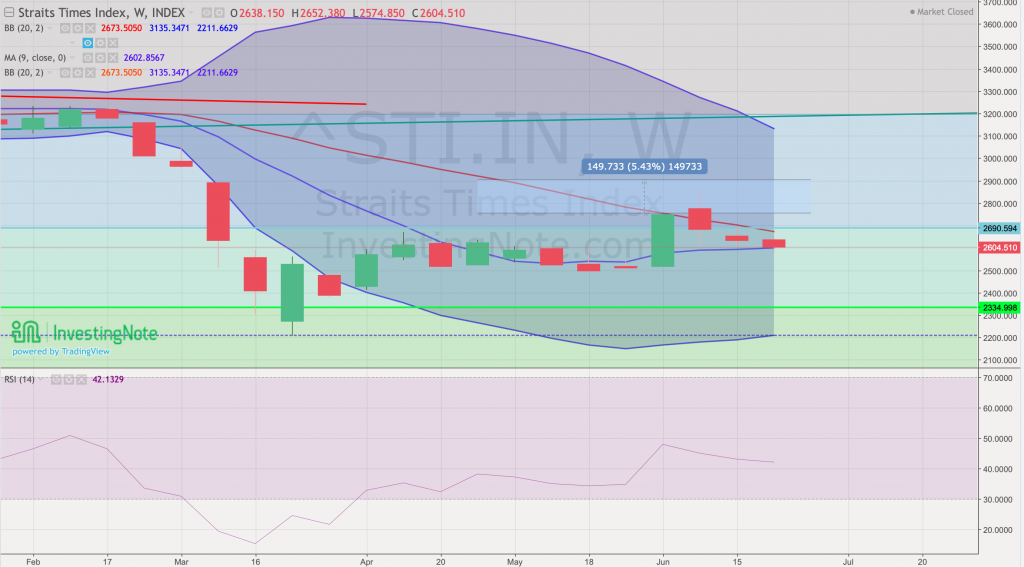

STI – Updated Weekly Chart

STI is resting on the 9 weeks moving average but it seems like further weakness can be expected in the coming week. The market sentiments at the moment would unlikely to be optimistic as there is no good news reported in the past weeks. The critical support to look at would be GSPC at 2950 levels and if it breaks, 2800 will be the next support.

Author’s Call as of 28 June 2020

- STI has retreated along with the US indices in recent days and is approaching 2500-2550 levels

- The current situation in the market is bleak unless there is good news with regards to the virus in the coming week

- Opportunities are arising for further accumulation as markets continue to show weakness.

- Volatility is likely to increase in the coming week

Author’s Call as of 21 June 2020

- STI is on an uptrend in general but does not seem to show any aggression at the moment

- The uncertainty caused by fear of a second wave and geopolitical tensions between China and the US is holding the market back

- Value hunters are still anticipating further weakness after failing to break 20 Weeks MA

- Singapore market is currently showing greater dividend investment potential than other markets, as others are generally presenting greater growth potential.