The market is waiting for results to speak for themselves

The era where events that can trigger overwhelming optimism is over, the market is slowly moving back to the times when results should speak for themselves. Essentially, investors are waiting for hard evidence of how well the economy will actually bounce back before they decide if the upside gained all this while is justified. Additionally, investors are also keen to find out what are the real impacts of inflation globally as it affected everything from food prices to energy. Perhaps now is the time for some reflection rather than excessive action as the market evaluate stock prices based on individual counters rather than overall market or sector performance.

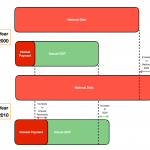

STI – Updated Daily Chart

An update to the daily chart from last week’s market activity show that the Singapore market is still waiting for more confirmation of the recovery before it is willing to go any higher. This is a normal phenomena in the Singapore market where investors are not eager to trade because they are willing to wait rather than rushing into the market.

STI – Updated Weekly Chart

The monthly chart shows that April started with some level of optimism supported by the reopening of travel and land borders in Singapore. Hopefully this optimism will stay and be supported by hard facts otherwise a possible repricing will occur again abruptly when bigger players coordinate amongst themselves. Nevertheless, sell some first if you are unsure and wait for further confirmation before reinvesting in a particular stock.

Author’s Call as of 2nd April 2022

- Investors can slowly move from investing in sectors to individual stocks as companies will start to recover independent of government support schemes.

- The daily chart shows that the caution market is still waiting for more hard evidence before it is willing to advance

- April started well but it is still too early to tell since many counters are peaking in the past week

- Switch from a sector or recovery optimism play to a more nuance investing approach as the world will carefully evaluate performance post covid and inflationary impacts.

Author’s Call as of 26th March 2022

- The announcement for lifting restrictions that includes an optional mask wearing in the outdoor certainly caused the market to rally from Thursday onwards but we are still unsure how high is STI willing to go

- Daily chart’s V-shape recovery signals that we might be heading back to 3450 levels

- We saw another almost solid weekly candlestick on the weekly chart but is also up against the 3450 resistance level

- Investors should have started selling but perhaps it will also be a good time to take note about there is still ongoing global political instability which might tip the scales and pull down the market abruptly