US Trinity Index New Highs (GSPC, NASDAQ, DJI)

Last week, GSPC all time high aroused attention but also doubt in the investors worldwide. Could it be a tactical move by institutional buyers pushing retail investors back into the market?

My Take for STI for 4 to 8 November 2019

Singapore market rallying slowly in view of Q3 reports

As mentioned last week (28 Oct to 1 Nov 2019), STI will likely rally to 3222 (target hit). After which, there was some volatility in the market and noticeably, there are some counters which did not recover past fibonacci resistance. However with the added push from US markets, STI will likely continue to rally towards next fibonacci resistance. Take a look at the chart below for a clearer view.

STI – Near Term (Daily Chart)

Market is primed to rally towards 3300 unless there are negative news from Trade talks between US-China and/or US-EU. Currently markets are “illogical”, “confused” and fuelled by Greed. Kindly practice caution in the near term until US comes up with the solution to their massive debt.

Follow up for US Economy affecting Global Markets

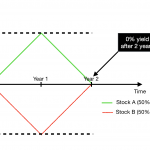

- US Debt (21.97 Trillion) is a real issue

- Credit bubble is not sustainable (able to to print more money and sustain positive yields for T-bills)

- European and Japan Economies are relying on US dollar to support their negative interest environment

- US Growth seems to be stable (Employment rates are up so are their indices)

- However, consumer confidence has fallen

- Optimism in the market for a Trade Deal with China

Overall, there is a high chance for US to delay an actual recession. This is because there are still several ways US can delay any real consequence. One of their powerful ways is to print more money to pay interest to T-bills (sell more of it to other countries) and Feds. Not to mention that other countries will likely buy more T-bills from US if required. In the long term, the long term debt cycle will arrive at the “endgame” unless US is able to repay their debt consistently by cutting their spending and repay federal debt.

Author’s view of STI (4 to 8 November 2019)

- STI rallying towards 3300 (3222 resistance turned support)

- US indices boost STI for the coming week

- Impending bad news from businesses when next Quarter reports are out (consistent)

- No long positions recommended

- Good opportunities for Swing trades especially quality companies that are currently depressed cause of trade tensions.

- Do exercise cautions as we are still at the mercy of SG Growth and US’s sudden bad news.