STI still reluctant to rally and stays conservative

2 Weeks ago, I informed everyone that the Singapore market is heading back to pre pandemic times where investors want results of companies to speak for themselves. Right now, the market is demonstrating just that as the reopening does not mean that the recovery will be of X% hence, this skepticism is understandable. Although we will be seeing a majority of companies reporting improved financials, lets not forget about their newly obtained debt as well as rising interest rates. Not to mention that the situation in Ukraine and China are still going on. Therefore, if you are trading actively, do expect prices to ocassionally spike or dip when the news strikes sectors or companies or else prices should remain at its hovering state.

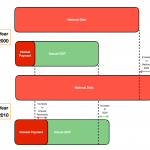

STI – Updated Daily Chart

The daily chart again spiked upwards on Friday but did not close with a green candlestick suggesting weakness in the market. At the moment, it is resting on top of the 20 days moving average but this is not comforting news because the market should be way more optimistic from the opening. As such, do take more days of references to determine if the market is still going to stay around 3300 to 3350 level.

STI – Updated Weekly Chart

This weekly chart honestly did not help much as candles from the last two weeks merely show that stocks are still exchanging hands in the Singapore market. Perhaps as the market settles, more investors might head back to growth stocks instead.

Author’s Call as of 30th April 2022

- The Singapore market is still not showing obvious directions ahead despite the reopening news

- Charts are not supportive on any bullish or bearish sentiments as well

- Friday’s was not good news, perhaps inflationary fears are catching up hurting the overall sentiments in the market

- Investors should continue to calibrate their portfolios according to their comfort levels, try to find stocks which you still expect to see growth and reduce on those that have poorer prospects

Author’s Call as of 23rd April 2022

- Unable to confirm if the optimism will last in the Singapore market as the world are still facing political instabilities

- The recent spikes might be due to investors taking refuge from other markets that are involved with the war and geopolitics

- The charts showed a rebound and a potential positive sentiment for the coming week if there are no other shocks

- Investors should be slowing down on their selling as many counters are paying out dividends in May