Fighting pessimism and delayed gratification

STI had a wild roller coaster ride in the past week, in fact, there were two attempts where STI failed to break into the lower limits of the parallel channel (shown below). It is obvious why many people are eager to make a profit and it is because prices rose very quickly on the morning of last Tuesday and Friday. In addition, there was also a growing concern of the FANG bubble growing to an unstable state and since STI corrects every time the US market sneezes, investors have become less ambitious when setting price targets. Having said that, Singapore has successfully restarted its domestic economy and is on its way to reconnect with other nations but it will still take some time before that can come into fruition. In this week’s post, we notice that STI is still in the state of sideways consolidation and has not shown any sign of recovery at the moment.

STI – Updated Daily Chart

STI daily chart show that investors are still reluctant to pump in more money for Singapore shares. Thus causing the shares to stay around the same price albeit displaying morning spikes as we are treading just below the parallel channel and at a historical low. STI also closed on a red after getting rejected by sellers stay above the lower limits of the parallel channel.

STI – Updated Weekly Chart

On the weekly chart, the 9 weeks MA has also crossed the 20 weeks MA which suggests a trend reversal or a false alarm when the last intercept point in early July suggested bullish signals. Nevertheless, there is currently little indication that an aggressive dive is on the horizon.

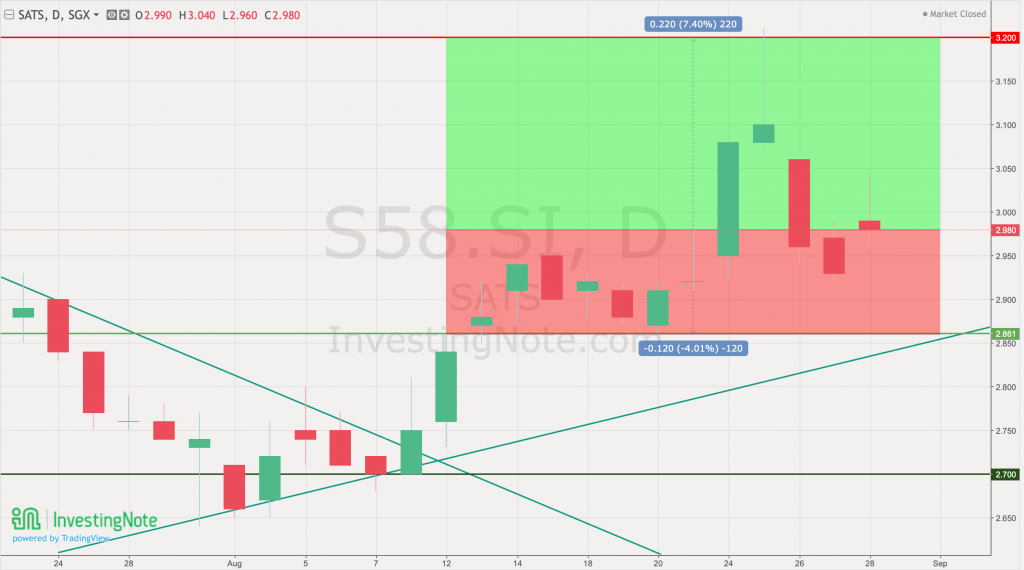

Special Feature – SATS (S58)

SATS is a tock that can be described as a pressure cooker, because every time when there is a slight reason for a rally, SATS still rocket upwards within a short period of time. This suggests that many algorithms are either waiting to strike for value or for a pump and dump play. Either way, we should be taking a closer look at the company where revenue channels has bottomed in the last 1Q reporting (making a small loss) and yet have a massive potential for a huge growth in revenue when the pandemic is “over” for the aviation industry.

Author’s Call as of 30th August 2020

- US market is making the world nervous because FANGS are defying all odds on its continued growth (perhaps related to election)

- STI has not given up on a sideway consolidation trend and investors are not showing interest to hold for longer term

- Short term interest in STI components continue to dominate the index

- Value is surfacing for domestic counters involving transport such as SBSTransit (S61) and ComfortDelgro (C52)

Author’s Call as of 23rd August 2020

- STI was disappointing for another week after Monday’s announcement which was funded by delays for other development projects in SG

- There is hardly any news on aggressive moves made to boost investor’s interest in SG on the news for most sectors

- SG’s aviation sector benefits from recent announcement to allow general travel to NZ and Brunei

- The overall market is not showing much downside risks and more good news might be on the horizon in the coming weeks