STI in for some turbulent times

Singapore Government has initiated the Circuit Breaker of SG Economy and society. They call it a Circuit Breaker to differentiate themselves from other governments who does a complete lock down. With such measures such as stay home unless you absolutely have to go work, replenish supplies or seek medical support, It will unfortunately pressure investors to react in a hasty and negative way. Though there will be the “Third” Budget, which will be announced at 4 pm on 6 April, the reaction of the market is still unknown from opening bell.

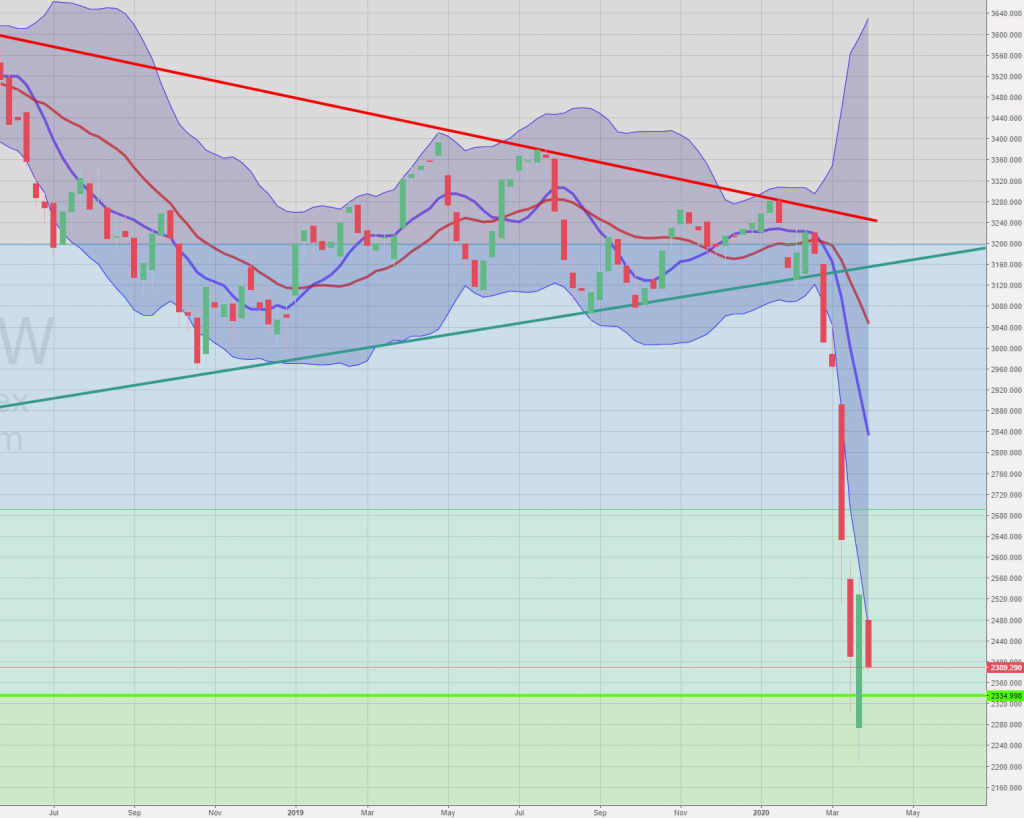

STI – Updated Weekly Chart

Last week’s market sentiments are apparently mixed because of the turmoil and influence from the US markets and at the same time, the introduction of additional measures to restrict movements and services. In the coming week, key support levels will remain at 2334.

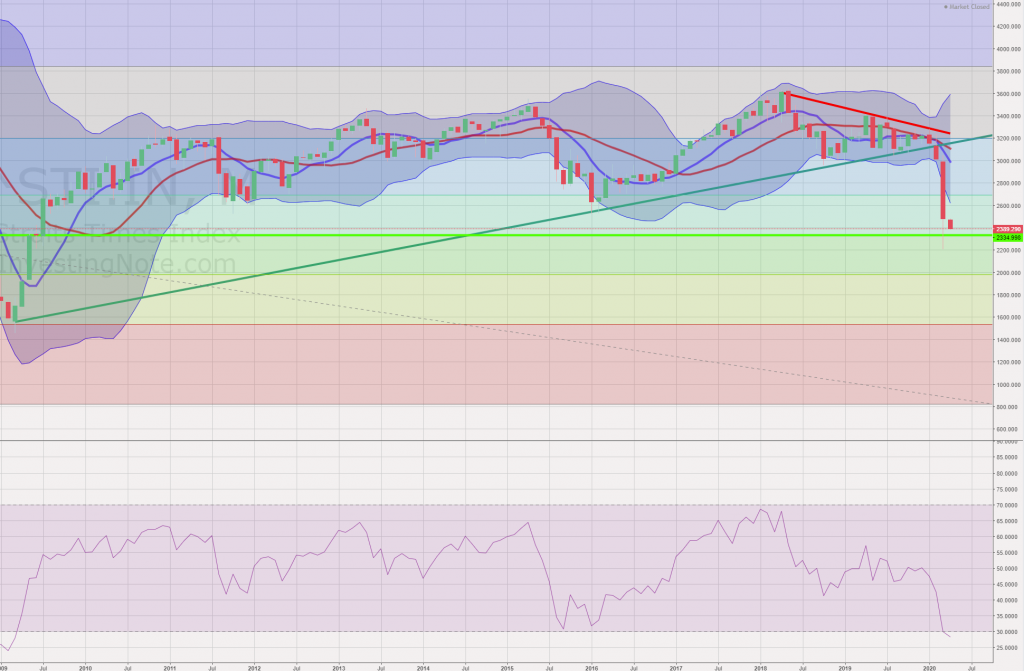

STI – Updated Monthly Chart

On the monthly chart, we are starting to see that there is a slow down in terms of the decline of STI. However, at last week’s closing, STI still closed lower than last month’s closing albeit above the support levels. In the coming weeks, STI will be hopping around the support levels again unless there are ground breaking discoveries to alleviate the virus (unlikely) or extreme negative news which will cause additional panic.

Author’s Call as of 5 Apr 2020

- STI rests above the support of the fibo retracement levels (however closed below last month’s candlestick)

- RSI (monthly shows that there is a slow down however still in oversold territories

- Collection of solid companies (giants with economic moats) are advised if STI is around 2334

- We are not off the hooks at the moment because the New measures might aggravate market sentiments after 2nd budget’s optimism

- 3rd Budget will send another wave of cynicism and fear especially for traders and shorter term investors.

Author’s Call as of 29 March 2020

- STI supported by fibo retracement levels (SG budget also provided a short term boost)

- Good time to accumulate if the price is right especially for companies affected by Covid-19

- Recommendations to buy in tranches and according to how much paper losses you can tolerate is key

- STI has been modest before the decline so there is lower chance for STI to continue to dive deeper than it did