SG CB measures started and SG 3rd Budget was announced but last week’s worldwide rally was peculiar

The title is designed too show how predictable financial markets really are. Say for example it dived last week, people will comment that it is expected due to Singapore’s CB measures but since it rallied, many would start rationalizing and coming up with acceptable reasons. Casting those noise aside, this rally is only going to be temporal and the situation is still not improving as much as we hope it would. At best, we could attribute last week’s rally to excessive liquidity in the market. So seriously what’s next?

Honestly, the news will likely change its tune soon enough and things will start looking gloomy again. This roller coaster ride is not over and we are still on the ride. Nevertheless, last week was a great week to take some decent profits and start planning future purchases again when fear is peaking again.

STI – Updated Weekly Chart

Looking at the weekly chart, the candle has rose above the bollinger band and finished solid green at the end of the week. The likelihood for next weekly candle to open higher than last week’s closing is high unless US futures decide to bailout before STI opens. Do bear in mind that CB measures are still in effect and there is really no reason to be greedy at the moment especially if you are already green on some accumulated shares in the past weeks.

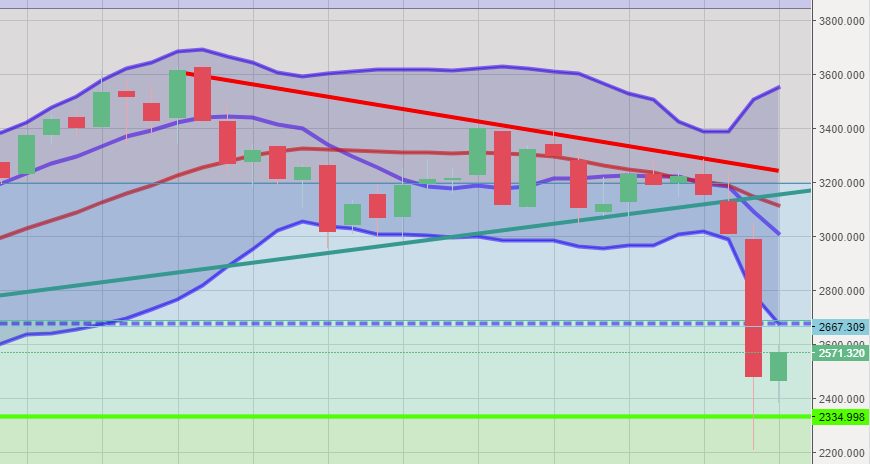

STI – Updated Monthly Chart

The reality is in the monthly chart where the unfinished monthly candlestick is still a gap below the lower limits of the bollinger band. Suffice to say that there is no signs of a “recovery”at all in terms of technical analysis or rather it is still too early at the moment. Nevertheless we should rejoice that the Fibo support level 2334 held strong and we should be able to see more buying at that level if we revisit it in the weeks or months ahead.

Author’s Call as of 12 Apr 2020

- STI closed green for the weekly chart above bollinger lower band but does not appear the same in monthly chart

- RSI showed a small rebound above oversold territory

- If rally continues it will have to pass 2667 which is unlikely at the moment

- At the moment there is little to celebrate because most countries are still lock down and are just peaking in the number of cases at best

- Accumulate with caution as the there is little reason to expect that the market as bottomed

Author’s Call as of 5 Apr 2020

- STI rests above the support of the fibo retracement levels (however closed below last month’s candlestick)

- RSI (monthly shows that there is a slow down however still in oversold territories

- Collection of solid companies (giants with economic moats) are advised if STI is around 2334

- We are not off the hooks at the moment because the New measures might aggravate market sentiments after 2nd budget’s optimism

- 3rd Budget will send another wave of cynicism and fear especially for traders and shorter term investors.