STI’s immunity stems from our banks’ performance

The recent correction for all tech stocks around the world continues and hence, STI is still off the hook. Finally, we can make sense of the disconnect between STI and other major indices. Evidently the rallies was initiated by tech stocks because the pandemic had minimal impact on tech products as demand continues to rise in 2020. STI’s heavy weightage have yet again pushed STI up almost single-handedly as other sectors hard hit by the pandemic like retail, domestic and tourism continue to stay modest. Interestingly, the optimism in the aviation sector has push share prices of SATS and SIA up to new high since the pademic hit in 2020. However, even those counters have retreated for the time being as STI hit its previous highs in January 2021. The current expectation is for STI to continue heading upwards but there are no guarantees that the tide will not change abruptly.

STI – Updated Daily Chart

In the near term, STI is trying to break out of 3010 resistance level and it failed to push through on Friday at closing. With Banks at their highs, we might see some level of retracements for STI as well. Afterall, the pandemic is still looming around the world, that implies that our domestic economy’s optimism might still be premature.

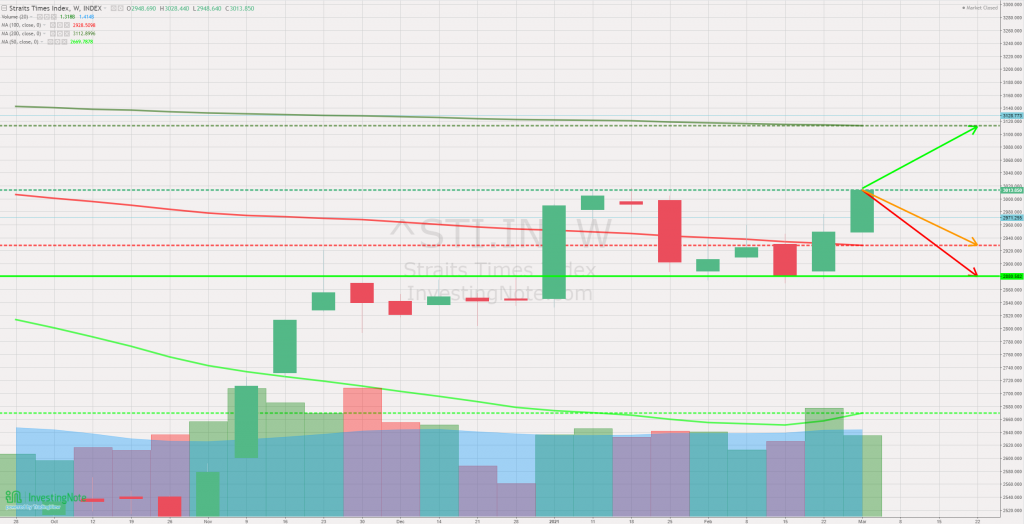

STI – Updated Weekly Chart

On the weekly chart, The sideways S-Shaped curve shows that STI is back on its feet after almost a month of weakness caused by the news about the new virus strain or strains. In the coming week, we should take notice of other markets to see if they are indeed reversing and such that happen, we might have to suffer another episode of corrections.

Author’s Call as of 6th Mar 2021

- Rally led by STI’s 3 banks is not uniform for other major components

- STI is back at 3010 resistance level formed in Jan 2021 before the corrections

- The US 1.9 trillion rescue bill is highly anticipated and might be passed soon to boost the economy

- Vaccination efforts continues to be the bedrock of confidence for Singapore’s economic recovery

Author’s Call as of 27th Feb 2021

- Tech stocks finally started their descend after a prolonged rally and euphoria over the past months

- The STI’s lack of tech counters displayed resilience during this particular correction

- Both daily and monthly chart shows that STI is still in the green at the moment however this situation might change

- Profit-taking will continue to take place as STI counters hit their own resistance levels