STI’s first significant rally in-line with reopening of economy

In the past week, STI has closed higher with each day’s closing. The question now is how long would the rally last and when should we hop off before the retracement begin. In today’s STI post, we will be looking at significant resistance and support ahead so that we can start planning an exit or even entry depending on the market conditions.

STI – Updated Daily Chart

Last week’s rally overcomes both triple top formation (orange) and the resistance on the weekly chart (light blue) line. The next level is at around 2789 which is identified on the monthly chart. Do continue to expected push back when nearing resistance level however continue to monitor RSI on the monthly chart if you want to plan your exit on some of your counters.

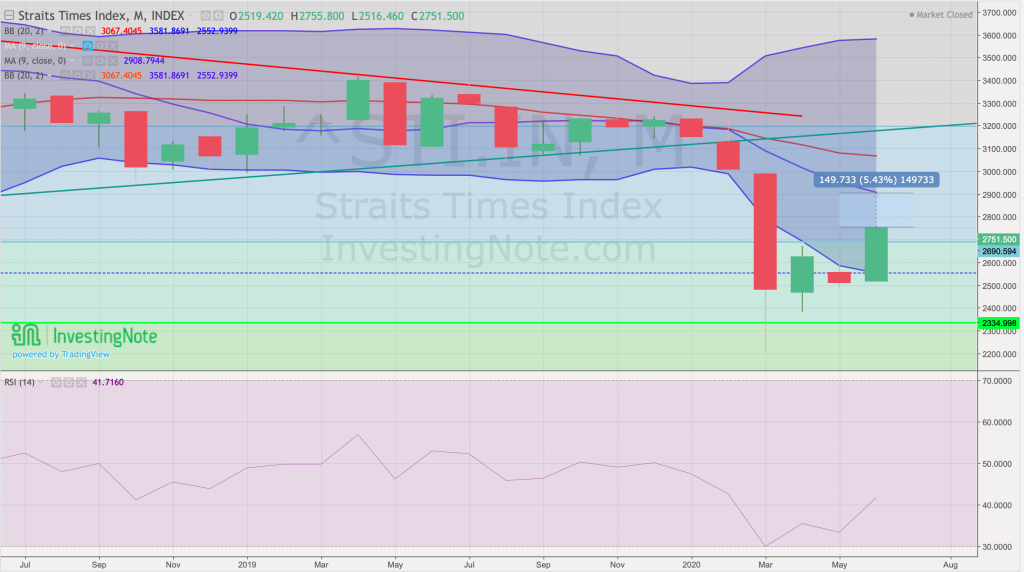

STI – Updated Monthly Chart

Currently, STI is heading towards 9 Months moving average which is marked at around 2900 or 5.43% upside. We will have to continue monitoring the ascend closely to know if the rally continues. Some reasons for the rally include more stimulus injected to help companies combat the impacts of the pandemic and much lower volatility on VIX in the US that shows greater stability. We can expect the market to continue climbing unless there is bad news about the resurgence of the virus either locally or in other parts of the world.

Author’s Call as of 7 June 2020

- SG Fortitude budget confirmed and will support the digitalization of the economy

- STI rally remains strong and the next resistance is at 2789 (5.43%)

- US VIX and Indices shows the market is stabilizing (thus supporting global rallies)

- STI has finally reentered Bollinger range on the monthly chart after 3 months

Author’s Call as of 31st May 2020

- STI held above support at 2500 (volume shows significant rejection and strong support)

- SG reopening parts of the economy on Monday and Stocks are set to open higher

- US Indices and futures are supportive of a recovering market around the world

- STI is lagging behind other major indices however with the support from the 4th budget, we do expect some upside in the near term.