Global Retracement following significant rally

As observed on the S&P 500, it has returned to 3230 levels on Monday on 8 June 2020. Following that, markets start to take profits knowing that the employment data from May will be worse off since April’s data was erroneous. as a result, STI is following suit and has retraced back to the resistance turned support level at 2668 a week earlier. As of now, STI is positioned to open flat or slightly positive since there was a rebound on the US market.

STI – Updated Daily Chart

After a 9 trading day rally, STI finally retreated to the mid-level of the parallel channels as drawn on the Daily Chart, the positive side of things comes from the fact that the steep gap was quickly filled and it ended with a Hammer showing that the short term retracement has largely ended.

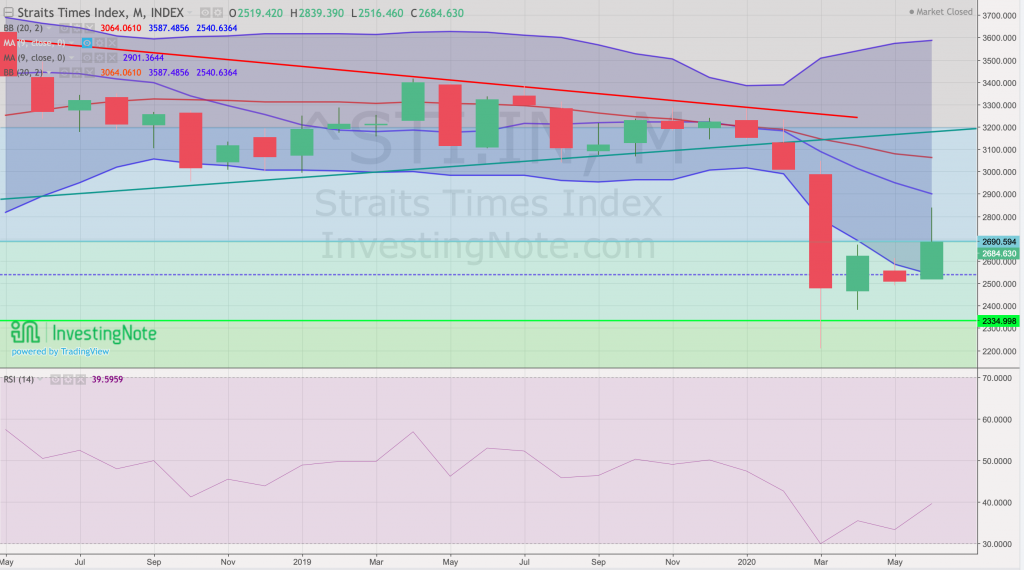

STI – Updated Monthly Chart

On the monthly chart, the 20 Months Moving Average has begun to flatten and it signals a weakening bearish sentiment albeit 9 Months Moving Average is still diverging from 20 Months Moving Average. As for its RSI, buying pressure is still increasing at the moment thus showing bullishness at the moment.

Author’s Call of 14 June 2020

- STI retracement last week ended with a hammer showing that buying pressure is higher than selling pressure

- STI is sitting above 2668 support is in the middle of the parallel channel drawn on the daily chart

- Many businesses are trying to restart but are still facing a shortage of demand

- The market is optimistic in view of this year’s general elections and full reopening of the economy

Author’s Call as of 7 June 2020

- SG Fortitude budget confirmed and will support the digitalization of the economy

- STI rally remains strong and the next resistance is at 2789 (5.43%)

- US VIX and Indices shows the market is stabilizing (thus supporting global rallies)

- STI has finally reentered Bollinger range on the monthly chart after 3 months