Corona Virus mutated from an economic to a social problem

The concern for the Corona virus seem to have abated or weakened in the past week. After seeing the immediate bounce from the uptrend support level at around 3130 to 3200 levels, it clearly shows that the corona virus is not seen as that big a threat to many industries in STI. As such, we could see signs of trend reversals for some industries which has been hit hard by the virus scares. At the moment, the virus seems to be vastly contagious but not as deadly as some might imagine. Therefore, there is likely going to be a deescalation of the alert from Orange to lower in the coming weeks.

As such, LOA and QO will also discontinue and only people who have breathing difficulties will be admitted directly to the hospitals. As for the rest of us, the virus will likely stay as a pandemic and/or a common virus bug floating around causing mild fevers and colds. Ultimately, the stock markets should begin to recover as soon as a medical professional is commissioned to speak on behalf of the world that this virus has been “thoroughly studied test has revealed that novel corona virus is classified as a non-lethal pandemic.”

So how will this affect the market in coming week?

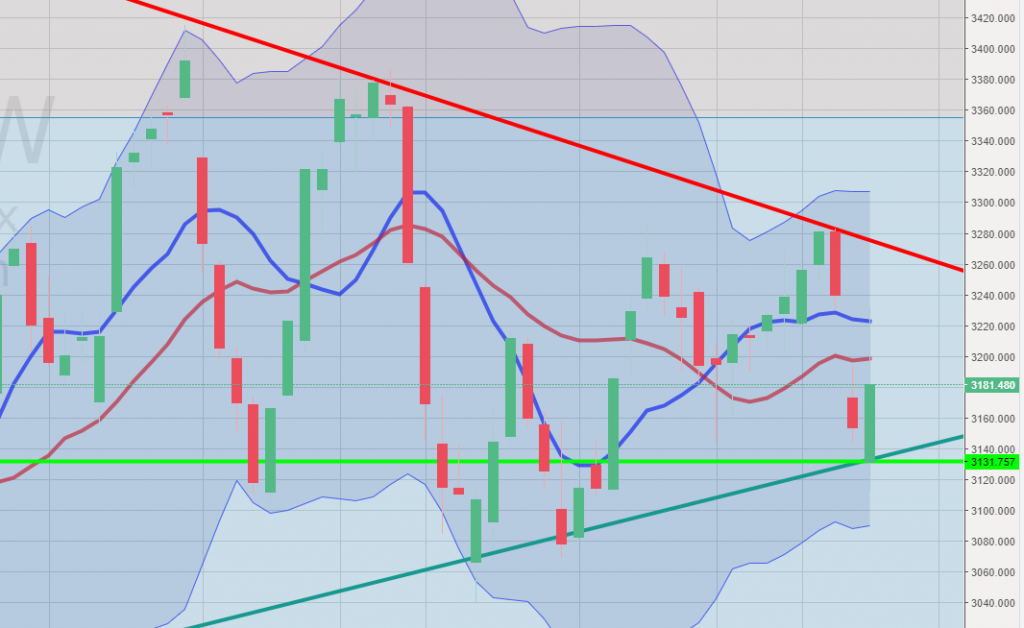

With the attention back on Trump being acquitted of his impeachment charges, the markets will continue to soar based on the massive liquidity and low fed rates. STI will also enjoy a free ride past its downtrend resistance at around 3250 levels and head back to 3500 levels. This is further supported by SG massive budget to provide business relieve over the recent national issues.

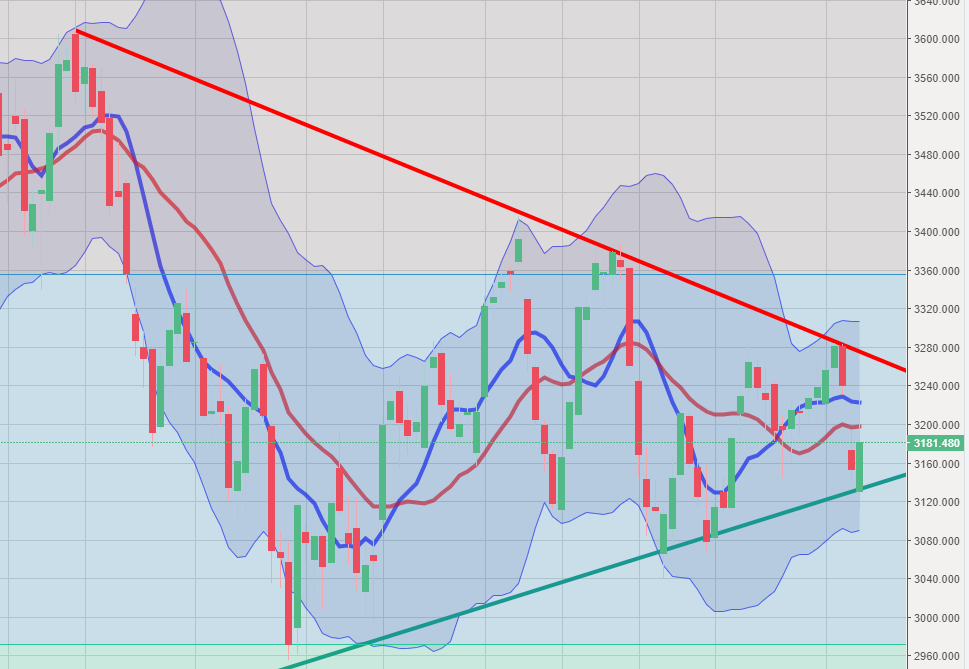

STI – Updated Weekly Chart

STI bounced back but it is still below both 9 and 20 weeks MA, as such, STI will still be consolidating until further news on the muting of the virus as a deadly disease is made. Though there is little concern over the rise in the numbers, investors will still play safe for now. Any sudden surges will likely be a short covering scenario otherwise a pump and dump.

9 and 20 Weeks MA no longer crossed due to last week’s recovery

STI did test the support level of 3130 but it bounced immediately showing the market’s unwillingness to head further downhill. In the meantime, do consider to accumulate on more stocks which are recently hammered by the virus scared and secure them before the recovery if you are able to either average down, or suffer potential paper loss. Either way, if you don’t buy when it is cheaper a few months ago, why would you ever buy any shares?

Author’s Call as of 9 February 2020

- STI recovered but currently still below both 20 and 9 MA respectively

- Corona virus impact on the economy is subsiding as the virus is not as lethal as expected by pessimists

- It might lead into a non-lethal pandemic at the moment, thus relieving pressure of the market and crack STI resistance at 3260 levels

- SG budget approaches with a strong focus on transport, business sustainability and virus management

- Consider to accumulate more stocks before Friday’s budget in time for a surge

Author Call as of 2 February 2020

- STI heading for a ride downhill due to virus worsening along with WHO status update

- STI is still modest hence the impact would be less severe as compared to US

- Fear still haunts all affected businesses and investors should exercise agency in the matter

- STI is heading for 3127 then 3000 if there are no turnarounds for the virus