Singtel is a telecommunications giant who is well known for owning minority to majority shares in telecommunications companies all around the world. Namely, Optus (Australia), Airtel (India), AIS (Thailand), Globe (Philippines) and Telkomsel (Indonesia). Personally, this form of strategic diversification across geographical locations provides a high level of resilience for its business. Furthermore due to their main focus in a “crisis-proof” business, we can be sure that their services will stay relevant.

How should we trade or invest in Singtel?

Short term outlook (Using Daily Chart)

- State of consolidation

- Price ranging around $3.10 to $3.35 to $3.50

- Supported by uptrend support (daily chart)

In short term, there is not much room for swing trading. price is still on the low side since Ex-Div on July 2017. If support at $3.10 holds, price will consolidate around 3.10 to 3.35 or even 3.5 if there is news on 5G rolling out.

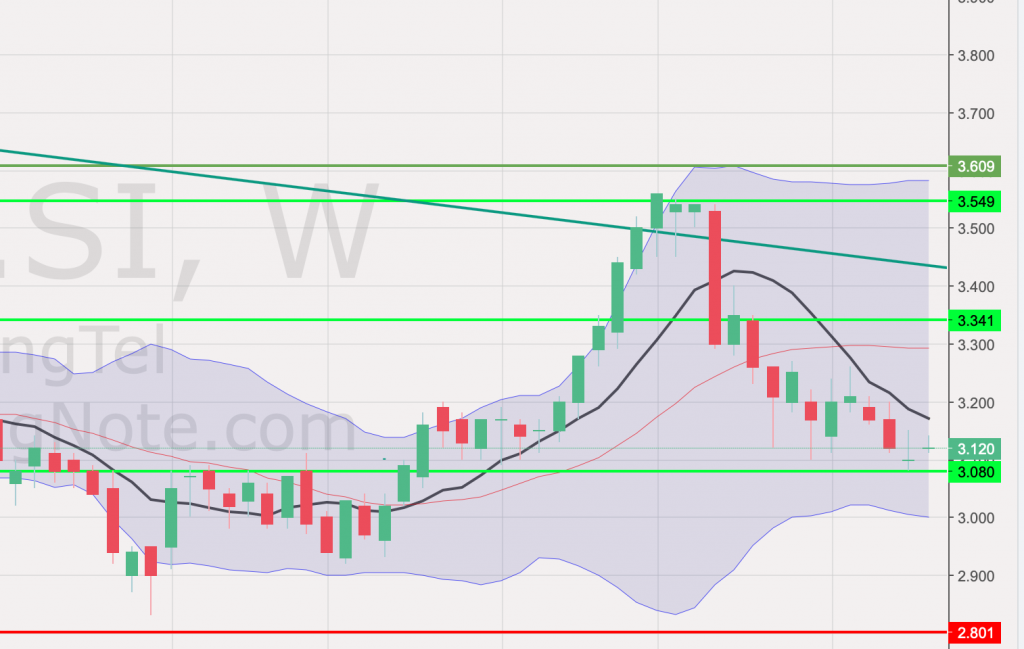

24 weeks outlook (Weekly Chart)

If we use the weekly candle sticks, we will have greater confidence in the support lines; however the drawbacks is that the resistance lines will be equally hard to break, thus causing longer wait times before hitting our exit price targets.

- Near Term stable $3.08 to $3.35

- Estimated $0.068 dividend payout in January

- Near Diamond bottom of $2.8

Looking at the weekly chart for Singtel, we detected that the price will likely bounce from 3.08 to 3.35. Taking into account the estimated dividend payout of $0.068 cents per share, the price will likely rally towards $3.35 soon after Cum-Div until Ex Div. However, do take note that should market conditions worsen, the price might go below $3.08 and head into the lower boundaries of $2.80 to $3.08 at the end of the year.

Author’s Call

- Buy at near $3.10 for short term profits (only for volumes above 3000 shares)

- Promising to buy and keep for 6.8 cents dividends (volume below 3000 shares)

- Setting Lower limit at $2.80 at the moment.

- Take profits at $3.35 to 3.50 (even before Ex-Div)

- Stop Loss at $2.75 (Sell)

*Do follow the above trading suggestions at your own risk*