Has Singtel recovered from its 668 net loss in Q3 or has it all along been priced in? We can see the price resilience in Singtel post Q3 results but not many investors are convinced that it is a legitimate recovery. The conflicting reason for its resilience lies in the Ex-Dividend date on 18 December which is likely a trap for some investors. There is a high likelihood for Singtel to fall back to lower support regions after Dividend cut.

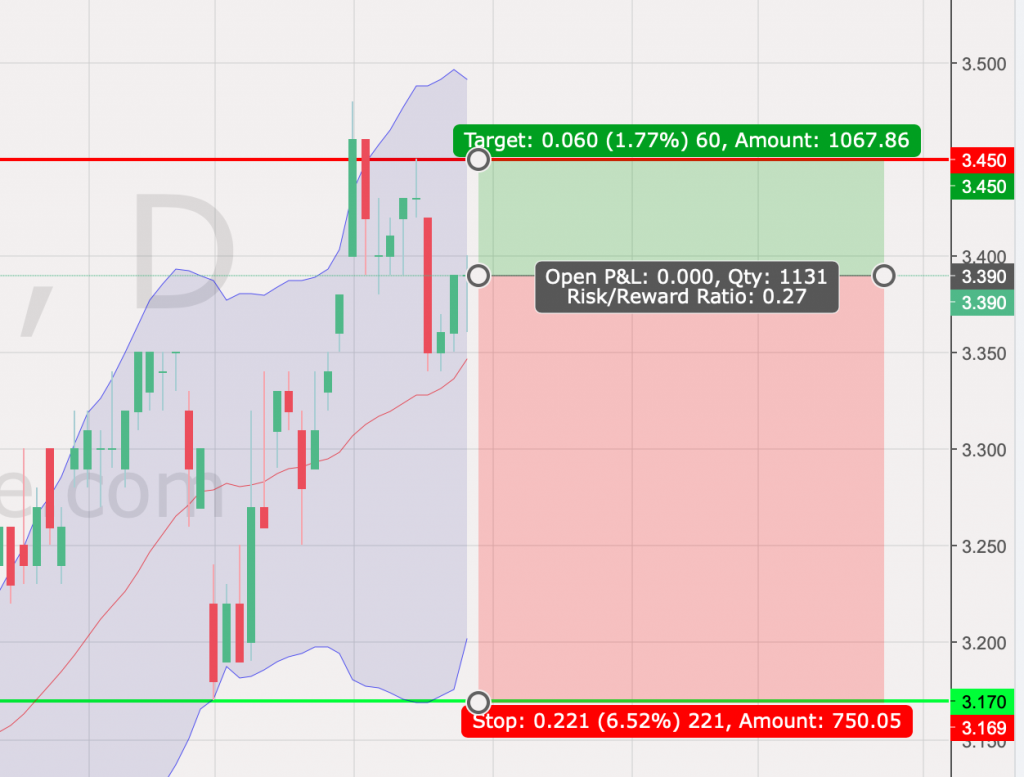

Near term outlook (Using Daily Chart)

As mentioned in the last trading ideas for Singtel on 2 December, there is really limited room for further upside. In fact, the optimism is likely short lived if the net losses have indeed been priced in.

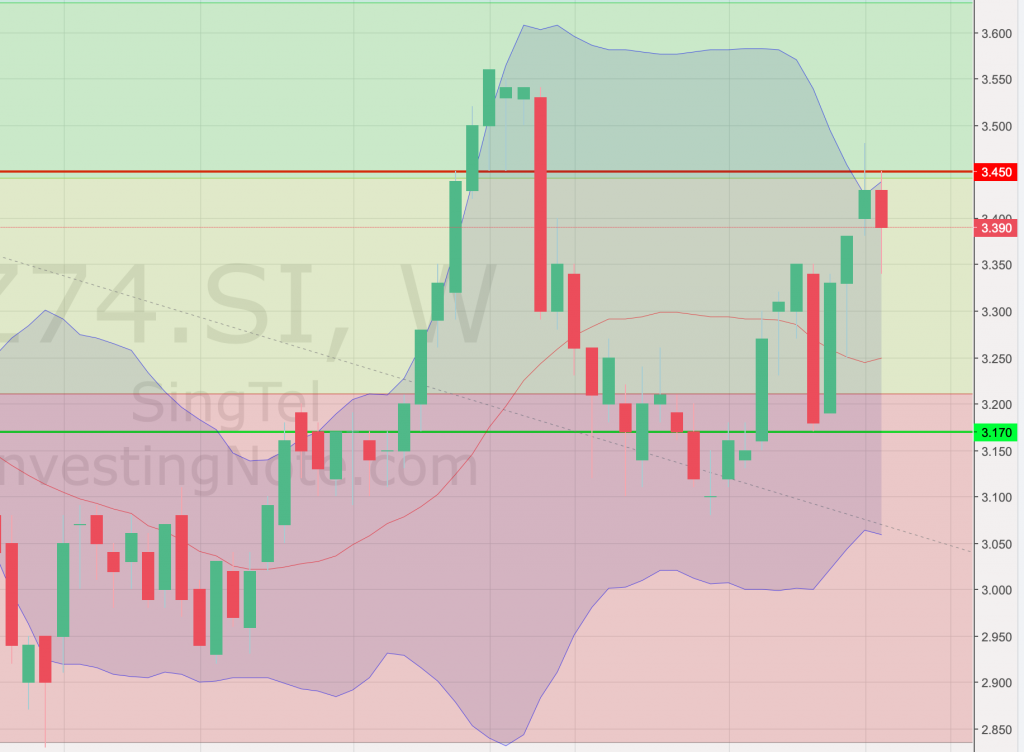

Weekly Chart Outlook

Resistance at 3.44 held for Singtel probably due to pessimism from traders as Ex-Div is nearing. I would rather wait for Ex-Div for the price to sink back to 3.2 before re-entering. Previous Trading Ideas for Singtel on 2 Dec has already signalled a Sell and I will hold that call unless you entered below 3.2.

Author Call

- Hold until after Ex-dividend on 18 Dec

- Price unlikely surpass 3.44 although might be testing 3.44 in the coming week

- Support at 3.2 likely to hold for Singtel after Ex-Div

- Maintain Sell for those who have earn more than 6.8 cents after commissions

Author Call (As of 2 Dec)

- There is a need to consider TP right now

- Resistance at 3.45 and 3.5

- Trade volumes are very high which signals pump and dump scenarios

- Overall still have to pay its dues for the losses with india

- Rentry at around 3.2, 3.1 and 3 will be ideal (intrenches)