Just to be clear with my intentions, I am writing this post just to explain how to stock pick and why investing in larger amounts cannot be based on popularism and hypes. Challenger has been on my portfolio ever since it started falling after a failed delisting and its first disappointing dividend. So why did I buy it when others sold it? In this post, I will pen down my thought processes and share what went through my mind as an investor and why value investing is still possible in today’s context.

Challenger’s fundamentals have been strong

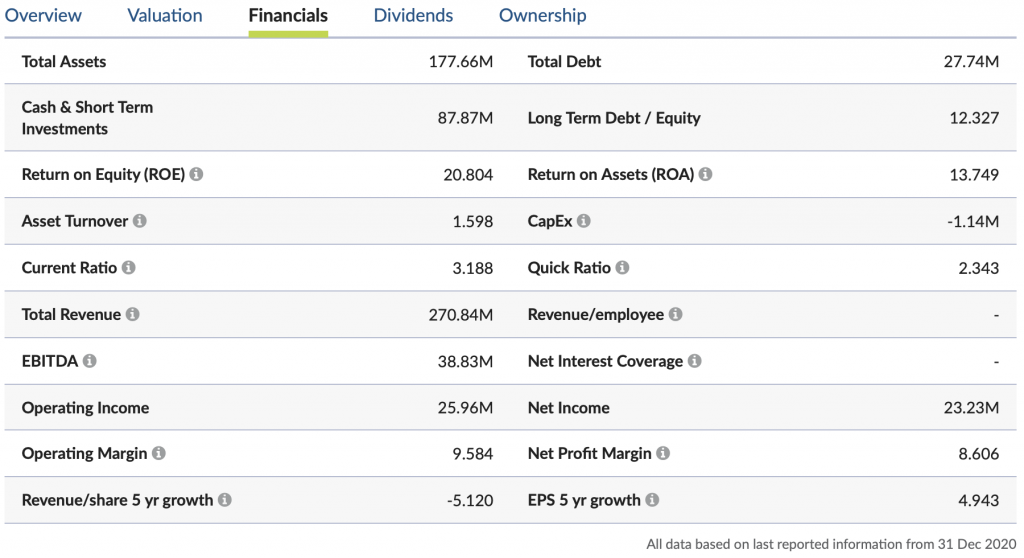

With a return on Equity (ROE) of 20.804, Challenger has done an exceptional job growing the company in 2020. Another notable its high cash balance also displays the company’s financial position in the midst of this pandemic. As the economy improves in 2021, we will be seeing an increase in revenue from all branches of its businesses, not to mention that the company also has no debt repayments in the coming year as reported on the financial report ending Dec 2020.

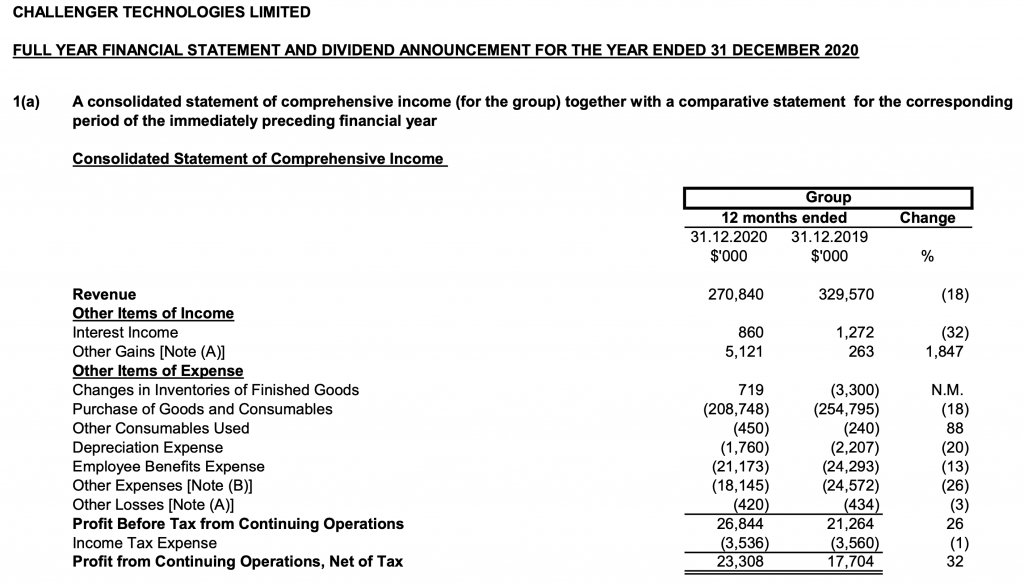

Financial Statement ending 31 Dec 2020

Despite the negative impacts of the pandemic, Challenger’s defensive stance and innovative solutions for enterprises have paid off and their net profit after taxes increase 32% year on year. This is no small feat considering the state of Singapore’s economy in 2020. That said, even if we exclude the mammoth amount of financial aid from the government, Challenger would have still turned a profit in 2020 of more than $13 million dollars which is 4 million less than FY 2019. Bearing in mind that this dip in performance is justified and way milder than other companies in the same retail business.

Why Challenger has potential for growth?

Singapore has been promoting the use of digital technologies and services to reduce disruptions and increase the efficacy of businesses. Therefore, Challenger has been positioning themselves to provide hardware and services to companies who require IT equipment, electronic signages, call center, and data management services. Although their non-retail businesses are still in their infancy, the company’s direction should continue to benefit from the digitalization of the country. Apart from that, Challenger can also exercise its option to relocate more of its business from brick and mortar shops to online sales to save cost and increase revenue over time.

Current Stock Performance

At the time of writing, Challenger’s share price has risen 9.28% since January 2021. The spike on the chart came right after Challenger announced its stellar FY 21 performance and dividend of 2.7 cents or 5.09% (payable in May 2021) based on today’s price of 53 cents.

Closing Thoughts

Ever since the delisting of Challenger failed in 2019, I realized that the fair value of Challenger should be way higher than 53 cents. If there will be another round of delisting, I sincerely hope that the exit offer will be more substantial but honestly, I would prefer to hold these shares and pass them on to the next generation.