Diversification has been defined by many as a simple division of one’s portfolio into a variety of financial products to generate steadier capital growth. Truth be told is that diversification alone in the products we invest in is not enough. In this post, we will be using a example to demonstrate the common mistake when diversifying. An alternative strategy will also be shared to maximize the benefits when diversifying.

Common mistake when diversifying (Buy and Hold)

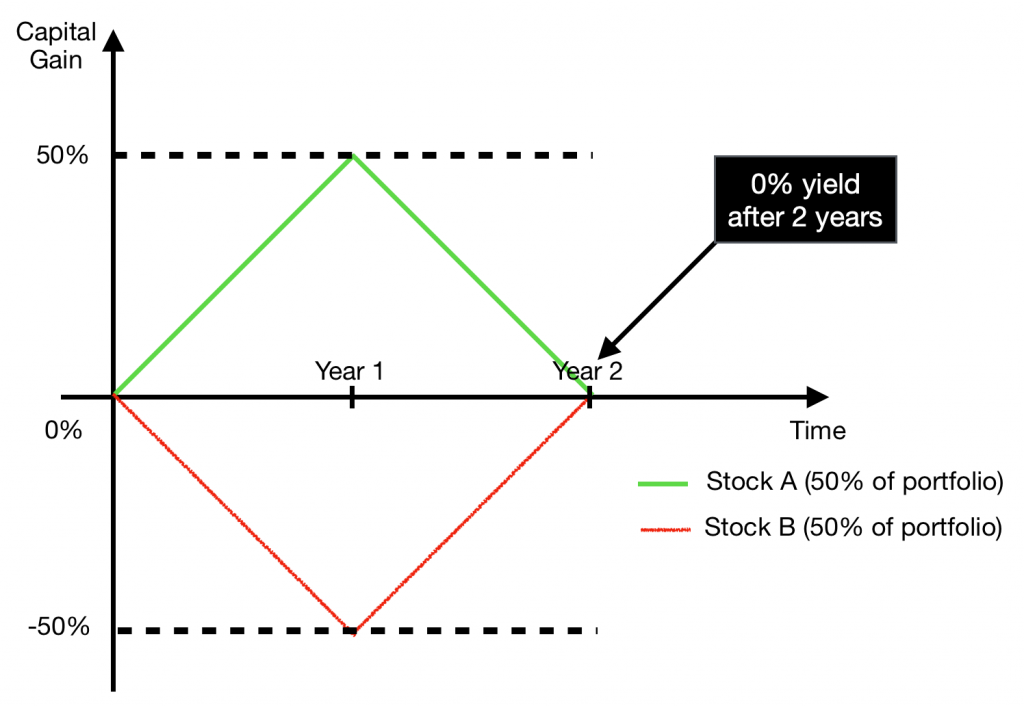

In the above chart, we notice that Stock A and B produce a net 0% yield after 2 years. In such a case, there were zero benefits after subjecting your capital to market risks. Surely there was no net loss in the above example, however as investors, we are only satisfied with positive yields. The follow-up question is how can we achieve positive yields given the same market conditions and investing in the same stocks A and B?

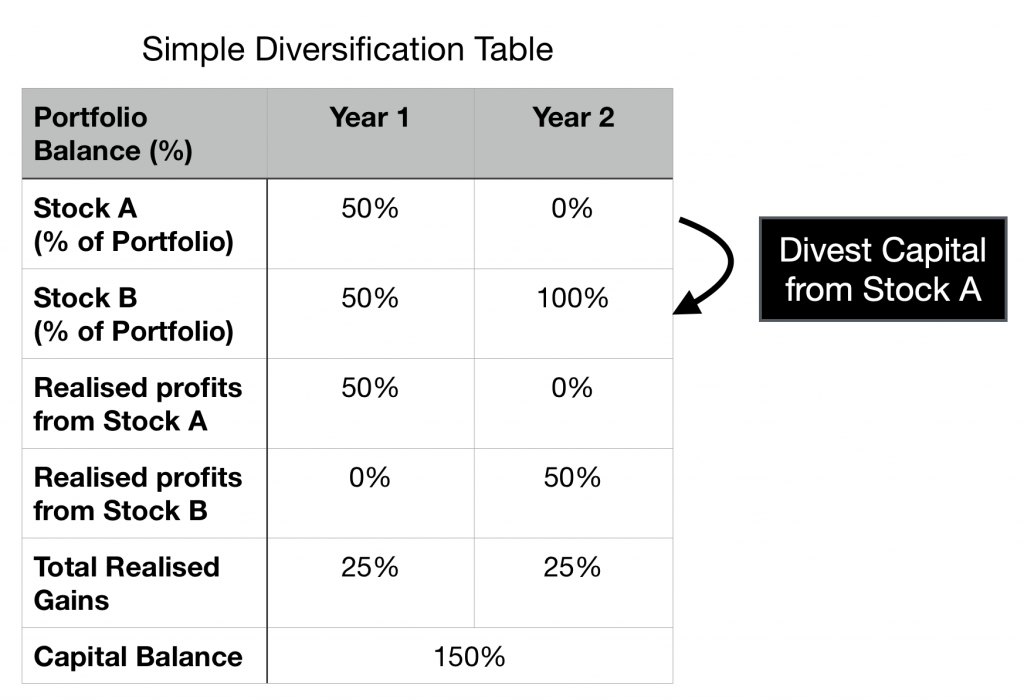

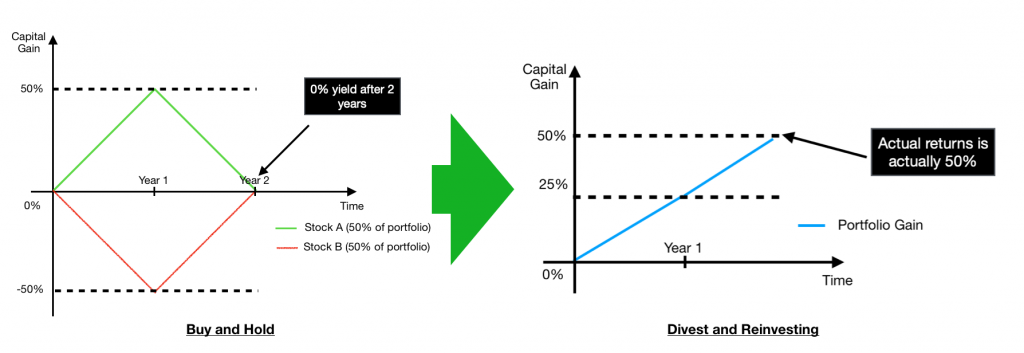

A simplified method is to divest from Stock A and reinvest into Stock B. This will either average down or in this case generate positive yields when it returns to its original share price at year 0.

From the table above, you would have yielded 50% instead of 0% if you simply bought more of stock B using divested capital from Stock A. This is because the paper losses made in year 1 would have been reverted back to 0% loss. Additionally, the new batch of Stock B purchased in year 2 would have yield 50% capital. This results in the overall net 25% yield for year 2. This might seem simplistic but this strategy of diversification has worked especially well for investors who are investing in cyclical stocks. To show the change in yields after changing our strategy, kindly see below for further clarification.

Closing Thoughts

While there is never a sure-win method when investing, there are many useful strategies that can help us manage our portfolios better to yield better results. These strategies will allow us to react accordingly during specific scenarios to maximize yields. In the above example, we have learned that divesting and reinvesting is a workable option if there are shares in our portfolio moving in opposite directions.