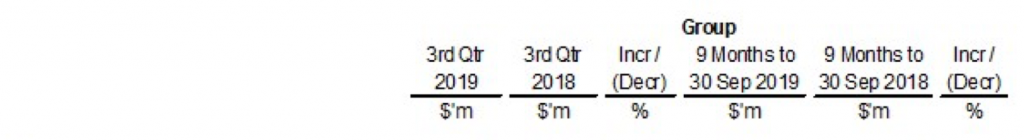

ComfortDelgro finished flat for Q3 and closed at $2.38 on 13 November. Profit after Taxation rose for 9M by 1.2% but fell QoQ by 6.5%. Decrease in profits attributable to the smaller fleet of taxis as compared to Q3 2018. The move to reduce the fleet is strategic as there is increase competition with private hires and some of the older taxis are getting old and requires more maintenance. See below for my entry and exit prices for CDG.

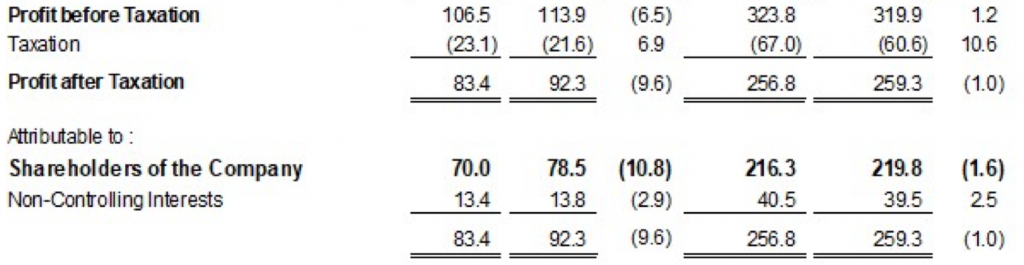

General Trend (Weekly Chart)

Fibonacci Retracement applied below

Plus points

- Resting on 2.37 support (2.30 support for contingency)

- Price depressed already before report release to account for smaller net profit if Q3

- Taxi business shrunk in response to competition from Grab (Strategic)

- Revenue from public transport to rise from 28 December 2019 (Price hike)

Negative points

- Cautionary alert for STI across the board

- Fibonacci resistance at 2.40

- Taxi rentals will continue to drop if Grab and Gojek sustains incentive for drivers.

Closing thoughts

I believe that current price is a fair price for a company that continues to allocate assets for further growth. Currently revenue increased marginally but Net profit fell with good reason. Therefore, it is still a well managed company.

Do take note that with the increase in revenue from the price hike on 28 December, the stock will be able to increase its profit margins. Along with the opening of Thomson lines, the public transport revenue will continue to increase from its SBS transit arm, as more people will be taking trains instead of longer bus rides. As for Cab revenue, I do hope that their purchases of new taxis in 2017 and 2018 will continue to have higher rental capacities with slight revisions in price. (Taxis still have its pros as it uses diesel rather than petrol and their car models are more durable than private hire cars, not to mention Taxis can be hailed.

Author’s Call

- Short term outlook stable – consistent

- Entry at around 2.4 if it closes above 2.40 – crosses 2 resistance (9 week MA and Fibo) – maintained

- rentry at around 2.15 if it falls

- Exit at around 2.50-52

- Did not hit 2.45 according to last post on ComfortDelgro (missed target by 4 cents – high of 2.41)