1. Capital Risk

Lets just say that if your total vested capital is $10,000. Then it means $10,000 of your monies are at risk of market price movements. Lets see how can we view risk in this perspective with a dividend portfolio. An example below.

| Year | Net Capital Vested | Annual Yield (5%) | Risk % (Based on $10,000 as 100%) |

| 1 | $10000.00 | $500.00 | 100% |

| 2 | $9500.00 | $500.00 | 95% |

| 3 | $9000.00 | $500.00 | 90% |

| 4 | $8500.00 | $500.00 | 85% |

| 5 | $8000.00 | $500.00 | 80% |

| 6 | $7500.00 | $500.00 | 75% |

From the above table, we learn that using primarily capital exposure as risk measurement will show that by Year 6, the risk has effectively reduce to 75% due to capital returns from dividend payouts. This mean that the longer you invest in stocks will result in less risk over time because the net vested capital will decrease over time.

2. Technical Support/Resistance (TA)

After holding on to a particular stock purchase for a month, you will be able to tell if you have entered the market at an ideal or less ideal period of time. For example. if your share price rose by more than 5% since u purchased it in less than a month, it is obvious that you have entered near a support line. Having said that, the real question is how do we identify the support line.

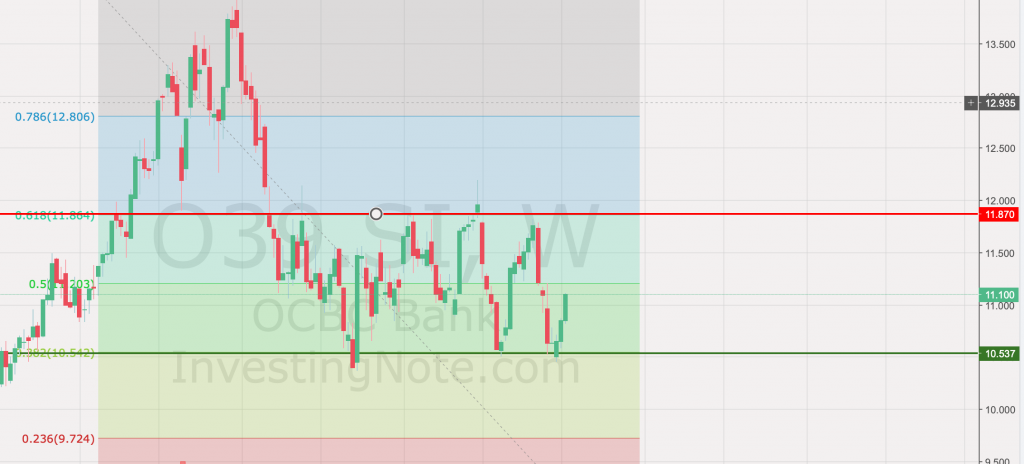

When entering the market for a long (BUY) position, Your risk can be mesured using fibonacci retracement method. Below is the fibonacci range chart for OCBC Bank.

The above instrument gives you a real life example of how we can identify support and resistance to have a better sense of a better entry (buy) or exit (sell) point.

Additional LOOPHOLE: Market Volatility (FA)

Counter-Intuitive Investing is less well known as it goes against conservative models. The reason is because when there is a sharp drop in the market, most traders tend to respond accordingly to cut losses and sell their holdings, only to re-enter when there are clear signs of recovery.

Buy when Fear is at its greatest, Sell when the greed has peaked

paraphrased quote

We may like to calculate most of our risk however there will be times when market sentiments supercedes logic. Hence, as investors, we will always need to embrace risk as a potential for growth/recovery if we would like to participate long term in the markets.