As always, such thought-provoking titles are sure to leave some people feeling confused. Both concepts of losing and losing out are different but how can both happen at the same time? In this post, we would like to dive deeper into the difference between losing out and losing in the markets. More importantly, will we ever be caught in a dilemma between either one of them? Actually, as investors, we are experiencing it very often, isn’t it? This is because staying out of the market does not necessarily mean that you do not lose? Alright enough with the “riddles”, time to unpack and explain what we are trying to share this week.

Setting the context for the post

For the past few weeks, many investors were puzzled every time they looked at the futures and indices because everything seems too green to be true. Many severely impacted counters have also been climbing aggressively and after every passing day, people have been spouting nonsense about it being the last day of the rally. The truth is, it didn’t really stop exactly when we expect it to. Some of us exited earlier than we should have and some entered thinking that the rally has just started. All of it boils down to two kinds of fear, are we losing out if we stay out or are we going to lose if we have hopped on the bandwagon.

Losing out feels almost as bad as losing

The feeling of losing out kicks in when you are waiting on the sidelines and looking at the markets climb without you and losing basically means looking at the market dive after you are vested. In those situations, my best advice is to think the other way around and understand that you would have lost in either scenario. Think about it this way, say for example you invested and the share price starts to fall, wouldn’t you have felt like you have made the wrong choice to buy in at that time? On the other hand, if you have sat on the sidelines and watched the markets climb, wouldn’t you have felt that it was wrong of you to not invest earlier?

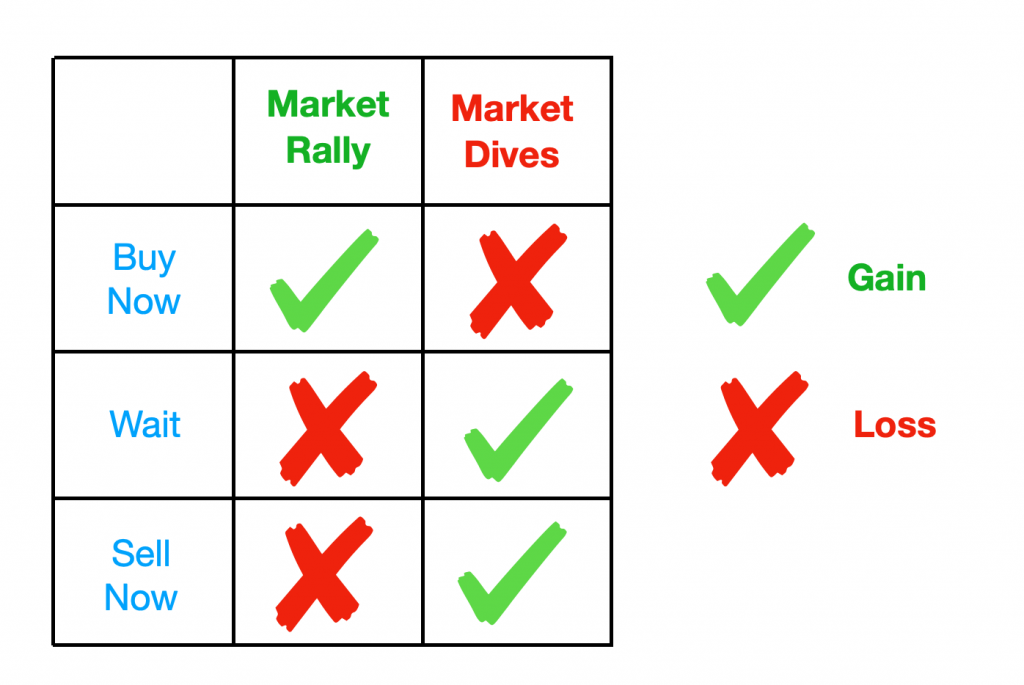

To break it down further in the form of a simple table, you will clearly see that you will both lose and gain in either scenario and there is no way of escaping “loss” in its entirety.

Every investor will have to face the consequence of their actions

Knowing that there will be either positive or negative consequences no matter what, it paints a clearer picture of whether we should risk losing or risk losing out. As mentioned earlier, it all boils down to whether the capital “At-risk” is worth its potential reward and on the other hand, will the reward be worth the potential losses. Rightfully speaking, at this point, there is no better person to advise you further than yourself. If you are an investor with huge amounts of funds to invest, then the odds of those losses making you feel uneasy is dramatically reduced. Whereas if you only have a small amount of capital, then you probably have to accept that perhaps investing in shares during volatile times is not a wise option for you at all. That said, you can always turn to alternative methods of investments such as BCIP or RSP in the period to take advantage of the dollar-cost averaging.

Closing Thoughts

So, how are we going to find a remedy for such a situation? The answer is in the word, “perspective.” For readers who have been following Loopholes Singapore for quite some time, you would have realized that our blog focuses most on perspective. The reason behind it is simply because we all come from different backgrounds and experiences. Hence, there is little to no value when comparing what we would actually do and how much we made from our investments. However, there is a common value which we all share and that is in the thought processes that we go through before, during and after our investment activities. In other words, stay vested but make sure you can still sleep at night.