A while back I did a post on the stocks that I have personally chosen to look out for during this Covid-19 Crisis. However, some readers ask me how I arrived at those counters and were wondering how they could identify their own watchlists. That is why today’s post will be on how to pick your own and how is this stock-picking process different from pre-COVID-19 times. Essentially what we are trying to achieve now is to find bargains during a sale because not all products on sale are “value for money.” On the other hand, we have to also look out for its future value. These will help provide some additional assurance that these purchases are justified and have a real potential for upside post-COVD-19.

How much cash does the company have to burn?

There are several ways to ensure that the company you are looking at has enough cash to tide past this downturn. Do check out SGX stock screener for a snapshot on the companies cash balances under balance sheets.

Basically, the amount of cash over current assets already shows how well managed a company is especially when ROE is above 15 for example (ROE>15). This shows that the company continues to be decently profitable over time and is able to generate decent returns for shareholders’ equity. That said, do take note of its current debt situation as some companies are loaded with debt despite showing healthy cash over asset ratio. Hence it is also important to double-check the net debt to equity or gearing ratio of the company.

For more details on watchlist selections, please click here for more details.

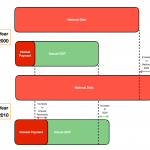

Essential (Must have), Essential (Contextual), Non-Essential (Must have), Non-Essential (Outdated)

Essential (Must have) services are services like supermarkets and telecommunication for example. These services are required to keep the economy moving. Without these services, living in a developed country like Singapore will become unbearable because there is a lack of means to conduct their Activities of Daily Living (ADLs). As such, there is no doubt that such services have to go on and keep up to date on their services.

Essential (Contextual) services are like our Airlines, these services are enablers for people to commute between countries safely and quickly. Therefore there are essential for the long run however contextually speaking, their importance might drop in the near term and hence their value might be affected as well. Even after post-COVID-19, if more business meetings are conducted via the internet, then the demand for such services will not return to pre-COVID-19 levels.

Non-Essential (Must have) like F&B industries and commercial services have been greatly impacted since dining out is prohibited during this period. Companies in F&B might not be seen as important during the crisis however we will expect to see a resurgence of consumer spending in those areas after the circuit breaker has been lifted. Hence I would say that companies share prices that have seen a dip in their businesses during the circuit breaker period is only largely temporal. That is unless their business has already been poor before the pandemic strikes.

Non-Essential (Outdated) industries like non-digital services which are much smaller in scale. I do not wish to expound on this segment with an actual example because I believe many companies are desperately trying to evolve during this period to stay relevant.

Foreseeable Future Plans

The most obvious sign of performance is increasing revenue, thus businesses have to expand their customer base and/or increase their range of services over time. Therefore, always look out for opportunities or potential areas where companies can grow in order to ensure that the company is investible in the long run. Do also ensure that the expansion plans are not to replicate the same services or sell the same goods in close proximity because of the law of diminishing returns. Besides that, go do some research on the upcoming technologies which will take the company’s services to the next level or save on cost. In other words, know the company that you are investing in. Lastly, do not base the future growth of a company on past performance. If possible, read up on the sustainability reports of the companies and see if they are moving in the direction which you agree with. This will help contribute to the confidence you have in the company.

Closing Thoughts

Covid-19 has brought market valuations of companies down substantially, however with huge volatility, many are wary of entering the market. In fact, the actual recovery might take more than a year from now to fully subside, therefore, always buy in tranches (dollar-cost averaging) and take a long term view for your investments.