Needless to say that stocks and property are two main instruments used by investors to generate regular returns overtime. However, we also understand that both instruments come in very different forms. As an investor of stocks and equity, you generally do no gain any tangible proof that you own a “small part of the company” whereas property investors have a physical space that belongs to its owner. Based on this difference, we will compare three main factors to weigh the pros and cons of investing in either instrument so that readers can make an informed choice.

Cost and commission – Additional Charges

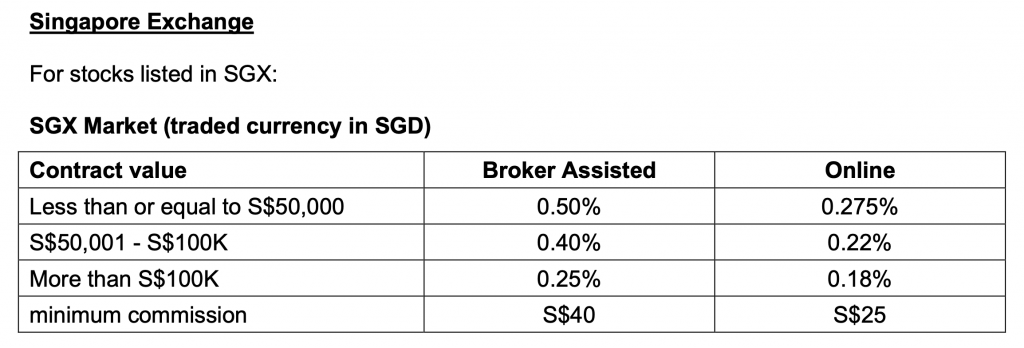

This comes with no surprise as there will always be service charges when it comes to purchasing and selling assets. However, the cost and commissions paid to transact stocks and real estate differ a great deal. For example for a typical agent fee for real estate, it is around 1-3% depending on the realtor’s company. However, for stocks brokerage, it is usually in the area of less than 1% per transaction. Below is the price for buying and selling stocks listed on the Singapore Exchange.

Comparing both commissions for transacting real estate and stocks, it is obvious that stocks are cheaper to trade. That said, the volatility of stocks is also an undeniable downside caused by the lower cost of trading stocks. Therefore, despite the lower cost, some investors are less inclined to invest in stocks compared to real estate as real estate prices are relatively less volatile.

Liquidity – How long does it take to liquidate?

The speed of both transactions of stocks and real estate also varies substantially. Stocks trading is straightforward and is carried out digitally therefore investors can buy and sell stock in an instant. However, buying and real estate usually take longer to find suitable purchases and buyers. During the process of searching for buyers or sellers, there will also be other miscellaneous costs incurred apart from the time spent for viewings and settling paperwork.

Liquidity is an important aspect of investing because opportunities sometimes come when you least expected. Therefore having the option to liquidate is a big plus point. This is especially common in stock investments because markets are constantly adapting along with the tunes of the economy. By having a faster transaction time, investors will have a lower risk for losses due to opportunity costs.

Returns/upsides – How much can you earn from stocks and real estate?

Barring all examples of mad stock price movements in recent years, bonafide investors do not make a killing every year. The average passive investor will usually yield 3-7% per annum, whereas active investors can yield anything from negative returns to around 15-20% depending on their capital quantum and strategy. On the other hand, real estate returns are usually slower, and ideally, a 2% to 7.5% appreciation would already be considered decent returns. This price appreciation does not include potential yield from rental or interest payments and other charges to own a real estate.

Although returns from both stocks and real estates are both non-guaranteed, there is still an argument for stocks to yield more because you can take advantage of the speed of transactions to yield higher returns from stocks in a year.

Closing Thoughts

Before comments and questions come in with regards to investing in both at the same time, do note that not many people have enough funds to invest substantially in both kinds of investment instruments. Furthermore, this analysis is made to compare the investment options therefore what truly matters is the potential returns. Other considerations such as risk are highly debatable but should also be taken into account as well. Therefore, when deciding to use either option to invest your capital, you should decide based on your time horizon, risk appetite, and knowledge to make the best possible investment for yourself.