The cost and difficulty of accumulating stocks are always underemphasized because most traders and investors, go in and out quickly, or diversify extensively such that there are few reasons to think about accumulation. Actually, accumulation requires a lot more understanding than most people think. Essentially, what you are trying to do when you are accumulating shares is to buy more at a different price. Therefore, you not only have to reconsider the new valuation of the stock but also the opportunity cost of allocating more capital into a single counter. In today’s post, I will be sharing my experience accumulating stocks and explaining why buying at a prolonged downtrend is always a wiser move compared to during an uptrend.

Accumulating during a downtrend

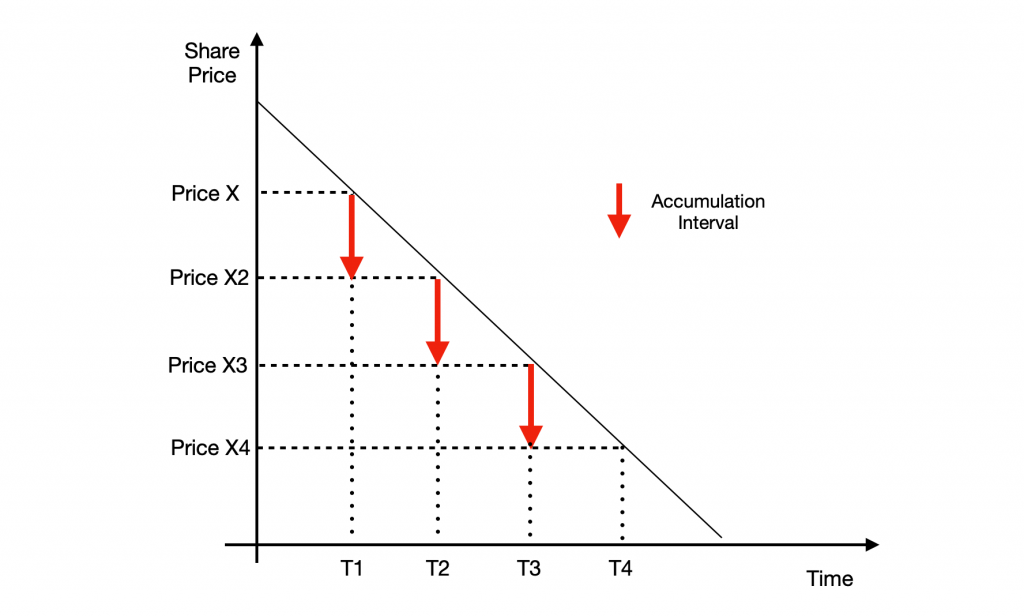

When accumulating during a downtrend, although the stock price stock goes down, we must always take the amount of paper loss into account because those losses will stack as well while we accumulate. Hence, the cost of accumulating does not actually decrease over time because the losses of your prior tranches increase over time as well. Before you decide to accumulate during a downtrend, keep the amount of paper loss in mind so that you will not over-commit to a particular stock or asset.

Accumulating during an uptrend

During an uptrend, although there are no paper losses incurred, the increasing price of stocks will actually lead to a higher average cost, which will be extremely detrimental if there is a trend reversal from an uptrend to a downtrend after you have accumulated a few tranches of a particular stock. The danger stems from the fact that there are no paper losses incurred during the process of accumulation, thus creating an impression that this accumulation is justified.

Closing Thoughts

As a rule, investors should all understand the real cost of accumulating stocks during both up and. downtrends. This is because the risk involved when accumulating stocks could increase the rate of making losses when the price falls eventually. Therefore, I strongly advise everyone to avoid accumulating at an uptrend because your upsides will be eroded very quickly and it is also harder to stay objective when no paper losses are incurred during the process of accumulation.